-

USD/CHF attracts some buyers around 0.8515 on the firmer USD.

-

The upbeat US labor data on Friday weakens the Federal Reserve’s (Fed) case for rate cuts.

-

Traders await the Swiss Consumer Price Index for December, due on Monday.

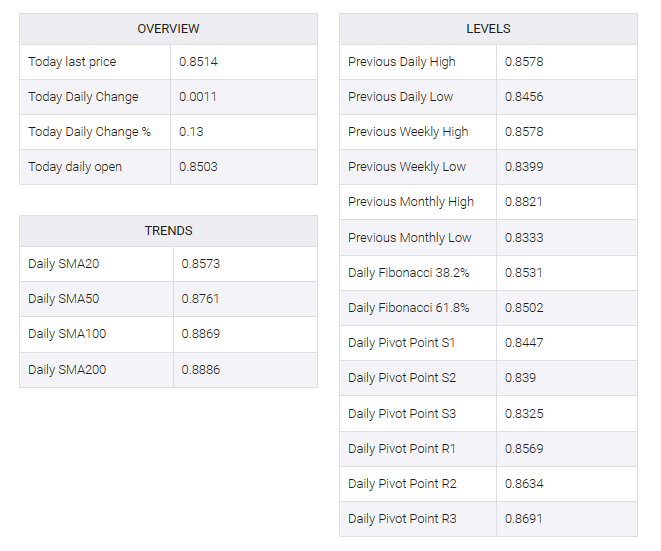

The USD/CHF pair gained momentum in early European trading hours on Monday. A recovery in the US dollar (USD) and higher US Treasury bond yields gave some support to the pair. USD/CHF is currently trading near 0.8515, up 0.13% on the day.

Friday’s better-than-expected US labor data weakens the Federal Reserve’s (Fed) case for a rate cut. Traders are pricing in a more than 60% chance of a rate cut at the March meeting, according to the CME FedWatch tool. On Friday, US Nonfarm Payrolls (NFP) rose to 216K jobs in December from 173K in November, beating the market consensus of 170K. Meanwhile, average hourly earnings rose 0.4% MoM, better than an estimate of 0.3%, while the annual figure reached 4.1 YoY in December vs. 4.0% previously, beating expectations of 3.9%.

Investors will take cues from the Swiss consumer price index for December, later on Monday. Annual CPI is estimated to show a 1.5% YoY growth from the previous reading of 1.4%, while monthly CPI is estimated to hold steady at -0.2% MoM.

The highlight of this week will be the US inflation data on Thursday. Market players project the headline Consumer Price Index (CPI) to show an increase of 3.2% YoY, while the Core CPI is estimated to ease from 4% to 3.8% YoY.