-

USD/CHF gains momentum for two straight days above the 0.8850 mark on Friday.

-

The pair holds above the 50- and 100-hour Exponential Moving Averages (EMAs) with an upward slope.

-

The immediate resistance level will emerge at 0.8875; 0.8838, acts as an initial support level for the pair.

The USD/CHF pair extended its gains above the 0.8800 mid-point for the second consecutive day during the Asian session on Friday. Meanwhile, the US Dollar Index (DXY) rose above the 104.20 mark supported by higher US Treasury yields and a risk-off mood in markets ahead of key events.

Philadelphia Federal Reserve (Fed) President Patrick Harker said at the Jackson Hole Symposium that the central bank has probably done enough with restrictive monetary policy. He also said he believes the Fed will keep interest rates steady this year, but will depend on data next year. However, Boston Fed President Susan Collins said further rate hikes were possible and it was premature to send a strong signal about when to cut rates. Market participants are awaiting Friday’s speech by Fed Chairman Jerome Powell at the Jackson Hole Symposium for fresh stimulus. Dovish comments from officials could boost the USD and act as a tailwind for the USD/CHF pair.

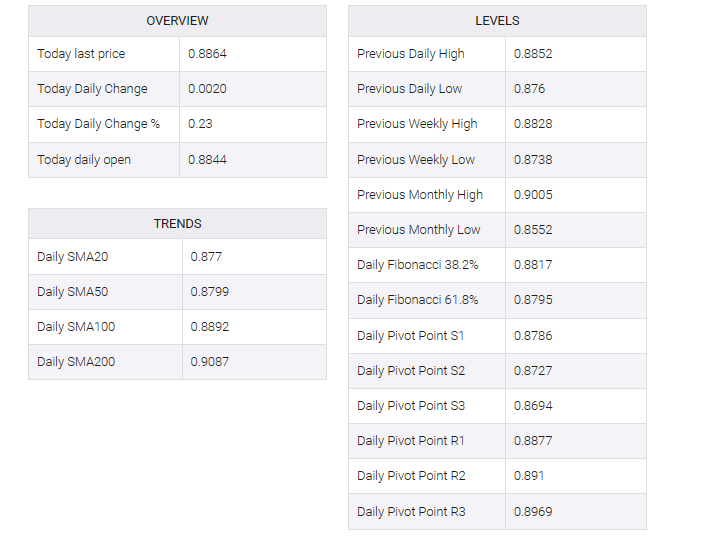

According to the hourly chart, USD/CHF is holding above the 50- and 100-hour exponential moving averages (EMAs) with an upward slope, which means the path of least resistance for the pair is to the upside. The Relative Strength Index (RSI) holds above 50 in bullish territory. However, overbought conditions indicate that further consolidation cannot be ruled out before positioning for any near-term USD/CHF appreciation.

That said, the immediate resistance level for USD/CHF will rise to 0.8875, which will represent the confluence of the upper boundary of the Bollinger Bands and the July 7 low. The additional upside filter to the route is located at 0.8915 (Oct. 10 high). to 0.8950 (July 6 low) and finally at 0.8970 (July 7 high).

On the flip side, the midline of the Bollinger Band at 0.8838, acts as an initial support level for the pair. Further south, the next stop of the USD/CHF pair is located at 0.8815 (the 50-hour EMA). The key contention level to watch is the 0.8800-0.8805 region, portraying a psychological round mark, 100-hour EMA, and the lower limit of the Bollinger Band. Any intraday pullback below the latter would expose the next downside stop at 0.8765 (low of August 22).