-

EUR/GBP reverses from two-week high to print the first daily loss in five.

-

UK BRC Shop Price Index drops to the lowest level since October 2022.

-

Germany’s GfK Consumer Confidence Survey gauge slumps -25.5 versus -24.3 expected and -24.6 prior.

-

British trader’s reaction to Jackson Hole, inflation concerns eyed for fresh impulse after long weekend in UK.

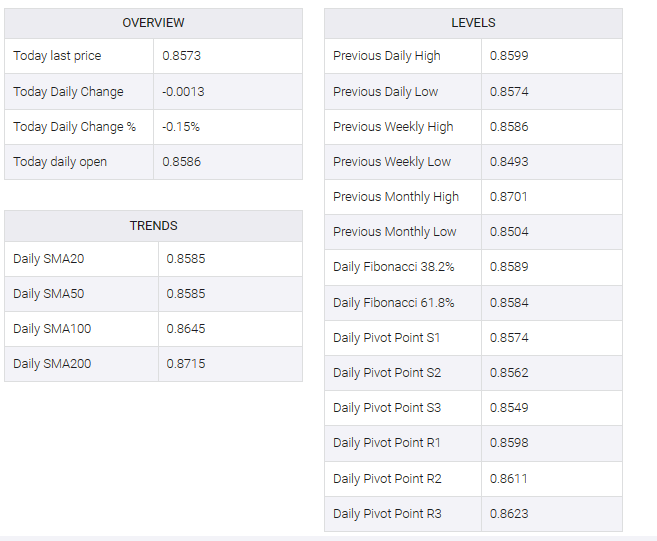

EUR/GBP bears return to the table after a four-day holiday as the cross-currency pair reverses from the intraday high heading into Tuesday’s European session. That said, the quote takes offers to refresh the daily low around 0.8575 by the press time.

In doing so, the EUR/GBP pair ignored subdued inflation signals from UK shops amid a downbeat German consumer sentiment gauge. In doing so, the quote depicts a U-turn from the 0.8585 DMA confluence mentioned in the technical analysis.

Germany’s GfK consumer confidence survey gauge fell to -25.5 in September vs. -24.3 expected and -24.4 earlier.

Earlier in the day, the British Retail Consortium’s (BRC) annual shop price inflation fell to its lowest level since October 2022 when it flashed the 6.9% mark for August, compared to 7.6% reported in July.

It’s worth noting that Germany’s highly influential IFO institute released a survey of exporters and cited deteriorating sentiment in August due to weak global demand, which boosted euro bulls earlier in the day. The survey also noted, “More and more companies are complaining of being less able to compete globally.”

However, French Finance Minister Bruno Le Maire ruled out any cut in European Central Bank (ECB) interest rates in the coming months and put a floor under the bloc’s currency.

Meanwhile, UK markets were closed on Monday due to the summer bank holiday but hawkish comments from Bank of England (BoE) Deputy Governor Ben Broadbent kept British Pound (GBP) buyers optimistic of late. That said, the BoE’s Broadbent cited the need for higher rates due to wage pressures at the Jackson Hole Symposium.

Going forward, a lighter calendar for the rest of the day could limit the EUR/GBP pair’s moves but the reaction of British traders to recent catalysts and this week’s top-level Eurozone inflation data could keep bears optimistic.

Technical analysis

A convergence of the 21-day Simple Moving Average (SMA) and the 50-day SMA, around 0.8585, appears a tough nut to crack for the EUR/GBP bulls. That said, the pullback moves can aim for the late 2022 low near 0.8550-45 amid lackluster oscillators.