-

USD/CHF rebounds due to downbeat Swiss economic data.

-

Investors will monitor Switzerland’s inflation data, seeking further cues on interest rate hikes by SNB.

-

Market participants await US economic data to gain a clearer insight into the Fed policy decision.

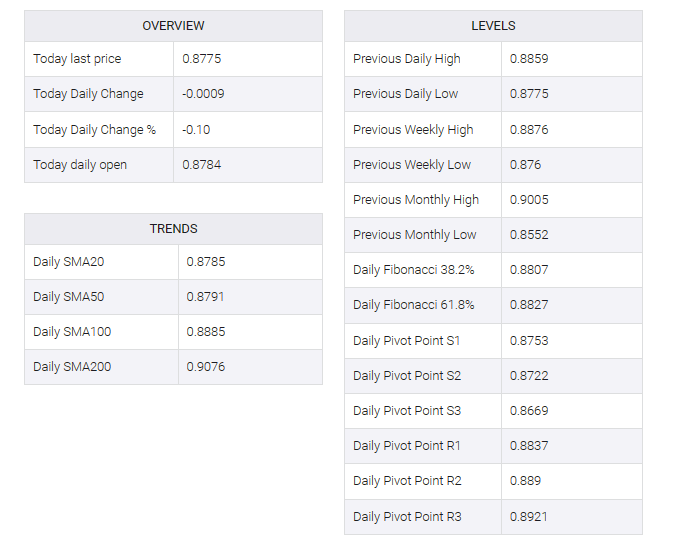

USD/CHF rebounds from losses registered in the previous two days, trading around 0.8800 psychological level at the time of writing during the European session on Wednesday. The pair is experiencing upward pressure due to Switzerland’s downbeat ZEW Survey – Expectations (Aug) released on Wednesday. The report showed a reading of -38.6 against the market consensus of -31.3 and from the previous -32.6 figure.

According to Credit Suisse, most analysts expect the Swiss National Bank (SNB) to implement another hike in key interest rates in the third quarter (Q3) given an expected pick-up in inflation in the coming autumn season. Furthermore, the Swiss Consumer Price Index (CPI) will be released on Friday, which is expected to slow in August. Market participants will monitor inflation figures to better understand the SNB’s next monetary policy decision.

The US Dollar Index (DXY) is recovering from recent losses and moving into waters near 103.70. This change can be attributed to the rebound in US Treasury yields, which is supporting the US dollar. It is worth noting that prevailing dovish sentiment surrounding the policy stance of the US Federal Reserve (Fed) is contributing to weakening the greenback.

During the Jackson Hole Symposium, Fed Chairman Jerome Powell emphasized that any future decisions on interest rates will be guided by data-driven analysis. As a result, investors are set to closely monitor upcoming US economic data to gain a more comprehensive understanding of the United States’ (US) economic trajectory.

Wednesday’s macroeconomic schedule highlights key events, notably the release of US ADP employment change figures for August and preliminary gross domestic product annual data for the second quarter (Q2). These datasets are expected to have considerable influence in formulating strategies before engaging in new trading positions on the USD/CHF pair.