-

AUD/USD strives for stability above 0.6500 for a fresh upside ahead of US NFP.

-

The Australian Dollar as a proxy to Chinese economy might come under pressure if China’s factory activities remain below 50.0.

-

AUD/USD has been consolidating in a wider range of 0.6336-0.6525 for the past 15 trading sessions.

In the New York session, the AUD/USD pair consolidated in a narrow range near the psychological resistance of 0.6500. Australian assets remain subdued as investors await US nonfarm payrolls (NFP) for August, due out on Friday. In addition to the US NFP, the ISM Manufacturing PMI will be closely watched.

After the US Automatic Data Processing (ADP) employment report, investors expect that the labor market is losing elasticity. Organizations are working with the current workforce due to the increasingly demanding environment.

Meanwhile, the Australian dollar will dance to the tune of Caixin Manufacturing PMI data. As a proxy for the Chinese economy, the Australian dollar could come under pressure if China’s factory activity remains below the 50.0 threshold.

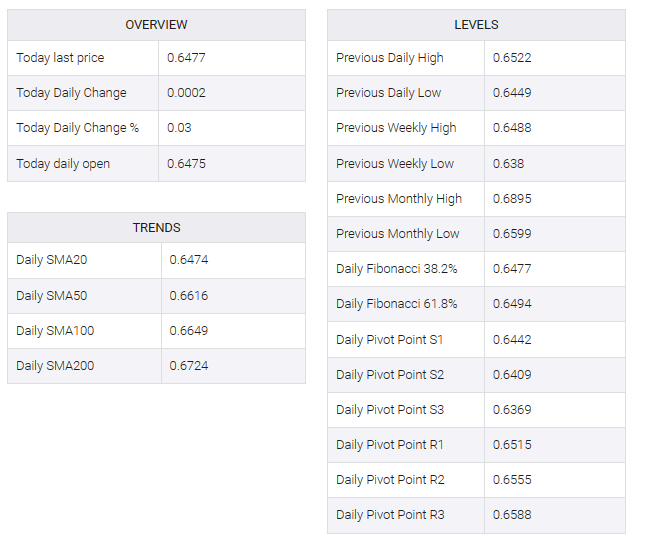

AUD/USD has been consolidating in a broad range of 0.6336-0.6525 for the past 15 trading sessions. The Australian asset aims to stabilize above the 200-period exponential moving average (EMA), which trades around 0.6480.

Momentum will turn bullish after the Relative Strength Index (RSI) (14) moves into the 60.00-80.00 range.

A recovery move above the August 15 near 0.6522 would propel the asset to the August 9 high of 0.6571. A breach of the latter would propel the asset towards the August 10 high at 0.6616.

In an alternate scenario, a fresh downside would appear if the Aussie asset dropped below August 17 low around 0.6360. This would expose the asset to the round-level support of 0.6300 followed by 03 November 2022 low at 0.6272.