-

EUR/USD weakened due to the Eurozone’s downbeat economic data.

-

Eurozone soft statistics increase the odds of the ECB shifting away from its hawkish stance.

-

10-year US bond yield rose by 1.85%; contributing to the strength of the US Dollar (USD).

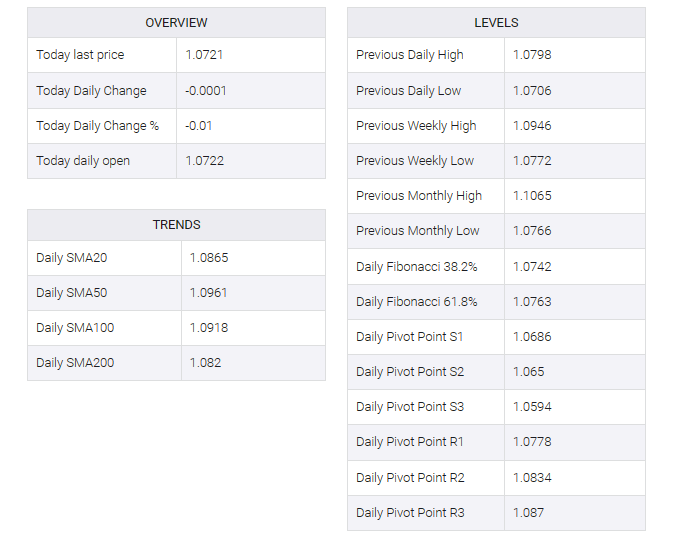

EUR/USD hovered around 1.0720 in the Asian session on Wednesday, crossing the water to snap the previous day’s losses. The pair is under pressure due to disappointing Eurozone data released on Tuesday.

Eurozone producer price index (PPI) for July fell to -0.5% on a monthly basis and -7.6% on an annual basis, from -0.4% and -3.4% previously. Further, the August HCOB Composite PMI declined to 46.7 from the previous reading of 47, which was expected to remain unchanged.

The discouraging figures raised the prospect of the European Central Bank (ECB) moving away from its dovish stance amid concerns about a possible recession. This is putting downward pressure on the EUR/USD currency pair.

ECB President Christine Lagarde advocates that central banks maintain a strong anchor on inflation expectations. Similarly, Deutsche Bundesbank President and ECB Council member Joachim Nagel also offered support for price stability but refrained from offering additional specifics at the time.

Furthermore, The Currency, an Irish business publication, published on Tuesday, August 31 an interview with ECB Chief Economist Philip Lane. In the interview, Lane praised the softening of August’s inflation data. Nevertheless, he stressed the importance of maintaining such favorable figures to resist pressure from the ECB’s more dovish members.

The US Dollar Index (DXY), which compares the greenback against six other major currencies, was trading higher around 104.80 at the time of writing. Buoyant yields on US Treasury bonds help the rupee maintain its strength. The 10-year US Treasury yield rose 1.85% to 4.26%.

However, United States (US) factory orders fell to their lowest level since mid-2020, falling -2.1% month-on-month, well below the -0.1% expected, and hanging on from a 2.3% increase previously.

Fed Governor Christopher Waller told CNBC that the decision to raise rates or stop raising rates depends on the data. Waller also said the data indicated a favorable outlook for a soft-landing scenario, a sentiment that bolstered the US dollar’s strength.

Market participants will likely look to upcoming data scheduled to be released later in the day. This dataset includes German factory orders and Eurozone July retail sales. On the US docket, the US ISM Services PMI and US S&P Global PMI are due for August. These releases will provide insights for determining betting strategies on the EUR/USD pair.