-

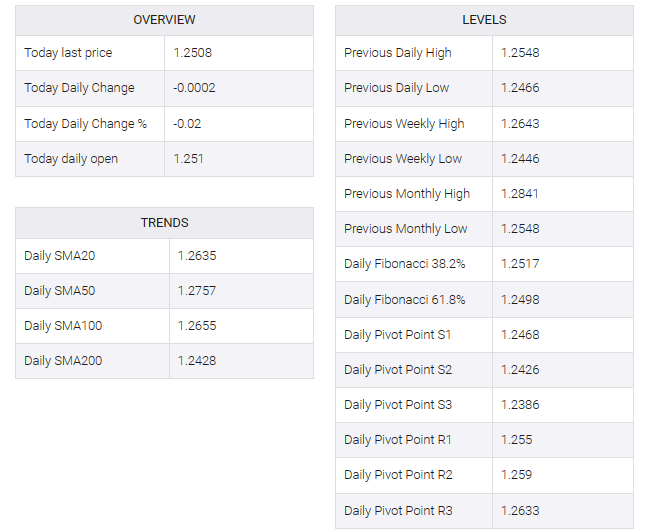

GBP/USD holds above 1.2500, lacks firm direction.

-

UK Unemployment Rate 3M to July came in at 4.3% from 4.2% in the previous reading.

-

Higher for longer interest rate narrative in the US boosts the US Dollar.

-

Investors will monitor the monthly UK GDP report and US Consumer Price Index (CPI) on Wednesday.

The GBP/USD pair consolidates its recent losses above the 1.2500 area during the early European trading hours on Tuesday. The major pair currently trades near 1.2515, up 0.04% on the day.

The latest data from the UK’s Office for National Statistics revealed that the UK unemployment rate in the three months to July came in at 4.3% from a previous reading of 4.2%, in line with market consensus. Meanwhile, July employment changes eased by 207K from a 66K drop in the previous reading, worse than an estimated 185K drop. Average earnings including bonuses rose 8.5% in the three months to July from 8.2% previously. Excluding bonuses, the figure remained at 7.8%, as expected.

Bank of England (BoE) policymaker Catherine Mann said on Monday that it was too early for the central bank to freeze interest rates and that it would be better for the central bank to err on the side of raising them too much instead of freezing them. Very soon. Dovish comments from BoE policymakers could limit the British pound’s downside and act as a tailwind for GBP/USD.

Across the pond, the US long-term interest rate narrative lifted the US dollar (USD) against the GBP with markets pricing in a 92% chance of holding rates at the September meeting and a 42.4% chance of a rate hike at the November meeting, according to the CME FedWatch tool.

US Treasury Secretary Janet Yellen said on Sunday that she is becoming more confident that the US will be able to control inflation without a major impact on the labor market. He added that every measure of inflation was wiping out and there was no massive wave of layoffs.

Market players will shift their focus to the monthly UK GDP report and July manufacturing production. Also, the highly anticipated US Consumer Price Index (CPI) data will be released in the North American session on Wednesday. Traders will have the opportunity to trade around the GBP/USD pair.