-

USD/JPY scales higher for the second straight day and climbs to a fresh high since November 2022.

-

Intervention fears might hold back bulls from placing fresh bets ahead of the crucial FOMC decision.

-

The technical setup suggests that the path of least resistance for spot prices remains to the upside.

The USD/JPY pair gained some follow-through positive traction for the second day in a row on Wednesday and hit a new high since November 2022 early in the European session. The spot price, however, retreated a few pips in the past hour and is currently trading just above the 148.00 round-figure mark, up about 0.15% for the day, as traders reposition for the highly-anticipated FOMC monetary policy decision.

Growing acceptance that the Federal Reserve (Fed) will stick to its hawkish stance and leave the door open for at least one more rate hike by the end of this year continues to act as a tailwind for the US dollar (USD). That said, speculation about an imminent shift in the Bank of Japan’s dovish stance, coupled with fears that the authorities will intervene to support the Japanese yen (JPY), will keep a lid on further appreciative moves for the USD/JPY pair.

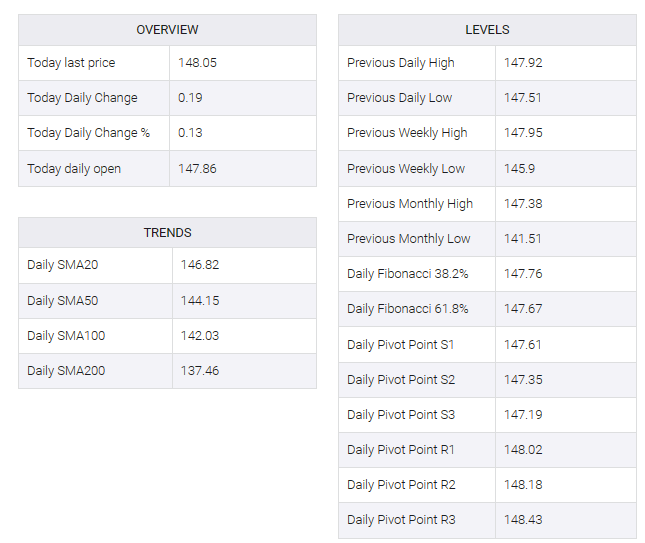

From a technical perspective, sustained strength and acceptance above the 148.00 round-figure mark could be seen as a new trigger for bullish traders. Furthermore, the oscillators on the daily chart are holding in positive territory and are still far from overbought territory. This, in turn, suggests that the path of least resistance for the USD/JPY pair is to the upside and supports the possibility of an extension of the recent uptrend.

Hence, some follow-through move towards testing the next relevant barrier near the 148.80-148.85 region, en route to the 149.00 round figure, looks like a distinct possibility. The momentum could extend further and take the USD/JPY pair to the 149.70 area before the bulls aim to regain the psychological 150.00 mark for the first time since October 2022.

On the flip side, any corrective decline may now find some support near the daily lows, around the 147.70-147.65 area, closely followed by the weekly trough in the mid-147.00 range. A credible break below the latter could prompt some technical selling and pull the USD/JPY pair towards the 147.00 round figure. The spot price could then slide to the 146.50 horizontal support, which if broken would reveal last week’s swing low or sub-146.00 level.