-

USD/JPY remains flat around 147.83 as investors prefer to wait on the sidelines.

-

Markets see the Federal Reserve (Fed) keeping interest rates unchanged at 5.25%-5.50% at its September meeting.

-

Japan’s top currency diplomat emphasized that Japanese authorities are dealing with FX moves with a high sense of urgency.

-

Market players await the Fed meeting on Wednesday ahead of the Bank of Japan (BoJ) on Friday.

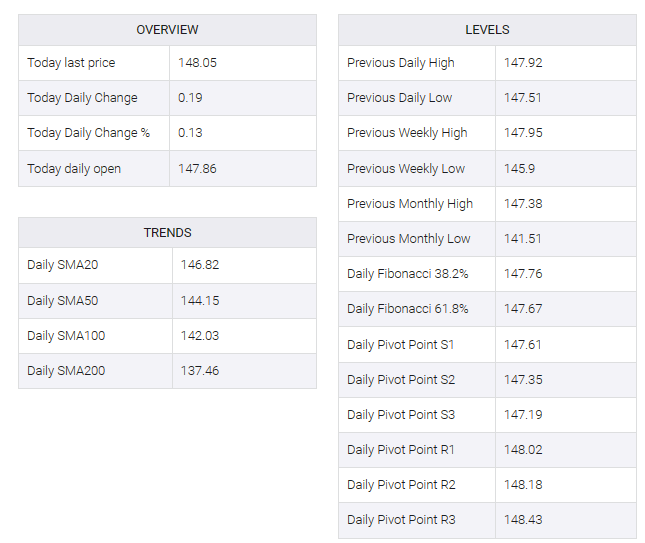

The USD/JPY pair traded in the 147.70-147.85 region during the early European session on Wednesday. At press time, the major pair was trading at 147.83, having lost 0.01% on the day. Markets were cautious ahead of the key Federal Reserve (Fed) interest rate decision in the North American session on Wednesday.

The Federal Reserve (Fed) is widely expected to keep interest rates unchanged in the 5.25% to 5.5% range. According to the CME Fedwatch tool, there is a 99% chance of keeping rates unchanged at the September meeting. However, according to the CME FedWatch tool, the likelihood of another rate hike at the November and December meetings has become less likely. This, in turn, could weigh on the US dollar (USD).

On Tuesday, U.S. Treasury Secretary Janet Yellen said the economy was operating at full employment, according to Reuters, adding that U.S. growth would need to slow more in line with potential growth rates to bring inflation back to target levels. In addition, the US Census Bureau showed on Tuesday that US building permits rose to 1.543M in August, above expectations and previous readings, while housing starts fell slightly to 1.283M.

On the JPY front, markets turn cautious amid fears of FX intervention. Earlier on Wednesday, Masato Kanda, Japan’s top currency diplomat, delivered verbal intervention comments, stressing that Japanese authorities were dealing with FX moves with high urgency. Additionally, US Treasury Secretary Janet Yellen said the US would consider another yen-buying intervention by Japan depending on the “details” of the situation.

On Friday, the Bank of Japan (BoJ) will announce its interest rate decision. The Bank of Japan is widely expected to keep its short-term interest rate target at -0.1% and its 10-year bond yield target around 0%. Markets are keen to see if Governor Kazuo Ueda will give any new signals on the timing of policy action and other changes to his yield curve control (YCC) during his post-meeting press conference.

Regarding the data, Japan’s Finance Ministry revealed on Wednesday that the August balance of trade was ¥-930.5S, worse than the expected ¥-659.1B. Meanwhile, exports were -0.8% YoY versus -0.3% previously, which was better than the -1.7% estimate. Imports rose from -13.6% to -17.8%, above forecasts of -19.4%.

Market participants will monitor the highly anticipated Fed meeting decision on Wednesday. The BoJ will announce its monetary policy decision on Friday. Traders will take cues from these events and find trading opportunities around the USD/JPY pair.