-

USD/CHF is on a bullish trajectory, ending the week with over 1% gains,

-

Pair is eyeing the 0.9100 mark, with a breach potentially exposing the May 31 cycle high at 0.9147, following a rally to the March 16 daily high at 0.9340.

-

Key support levels for sellers include the 200-DMA and the 0.9000 mark; breaching these could lead to a test of the September 20 daily low at 0.8931.

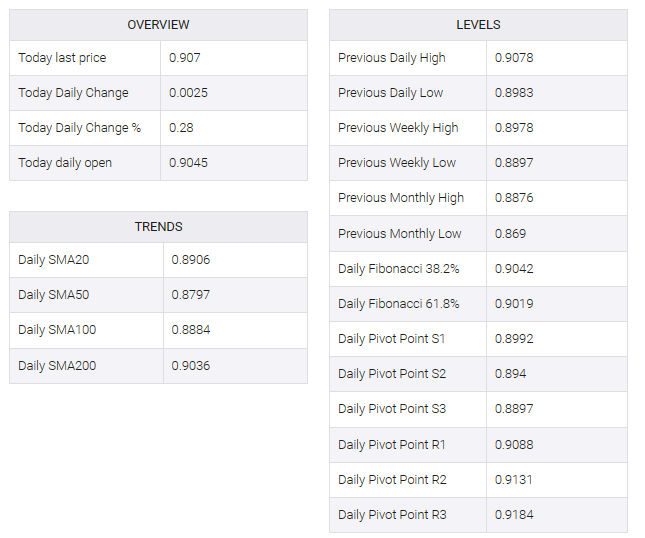

USD/CHF is set to end the week with decent gains of more than 1%, while breaking above the 200-day moving average (DMA), which could open the door for further upside, with buyers eyeing a new cycle high. Therefore, the pair is trading at 0.9071, edges up 0.30% late in the New York session.

The daily chart extends the pair’s gains before 0.9032 (200-DMA) and puts a challenge at 0.9100 in play. A breach of the latter would reveal the May 31 cycle high at 0.9147, which, if cleared, could push USD/CHF back to the March 16 daily high of 0.9340.

Conversely, sellers will face the 200-DMA and the 0.9000 mark. These two levels have been interrupted, and USD/CHF will test the September 20 daily low of 0.8931 before testing the 0.8900 figure.