-

The USD/CAD is recovering for Friday after slipping to 1.3425.

-

Rising oil prices are bolstering the CAD, but the USD has been finding market support.

-

Canadian Retail Sales rose for July, but slightly less than expected, reducing CAD upside.

USD/CAD ended Friday close to where it started, trading just south of 1.3490.

The Loonie (CAD) has turned around in the back half of the trading week, with the CAD and (greenback) playing a tug-of-war.

Rising oil prices have boosted the CAD lately, but a break in crude gains is testing USD/CAD in recovery territory.

Canadian retail sales rose 0.3% in July, slightly below market expectations of 0.4% but an improvement from the previous month’s -0.7%, which was revised upward from -0.8%.

Core retail sales (retail sales figures less automobiles) rose 1% for the same period, past analyst forecasts of 0.5%.

On the US side, Purchasing Managers Index (PMI) figures came in mixed, seeing a brief slip in the US dollar but shutting down the possibility of a determined move in either direction for the USD.

The preliminary US S&P Global Manufacturing PMI for September came in at 48.9 versus the 48 expected, easily clearing expectations. The Services PMI component slipped analysts’ forecasts, falling to 50.2 and reversing an expected improvement to 50.6.

Read more:

US S&P Global Manufacturing PMI improves to 48.9, Services PMI declines to 50.2 in September

The economic calendar is on the thin side for next week, but investors will be keeping one eye out for US Durable Goods Orders next Wednesday. Markets are expecting durable goods orders for August to print at -0.4%, a declining figure but still an improvement from the previous period’s 5.2% decline.

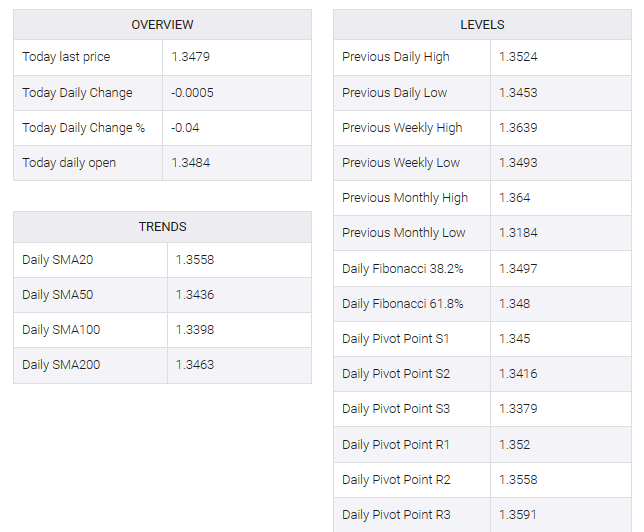

USD/CAD technical outlook

The USD/CAD is trying to recover from near-term lows into 1.3380, and is seeing the 200-hour Simple Moving Average (SMA), currently capping off intraday action from 1.3500.

The pair is 1.6% down from September’s peak just below the 1.3700 handle.

Daily candlesticks sees the USD/CAD stuck into the 200-day SMA, and market sentiment could flow in either direction moving forward.