-

USD/JPY edges higher to 149.70, near the 11-month highs on Monday.

-

BoJ Governor said there was “a distance to go” before exiting its ultra-easy policy.

-

The potential FX intervention from the Japanese authorities might warn traders from the bullish bet.

-

Market players await the US ISM PMI while keeping an eye on the 150.00 level.

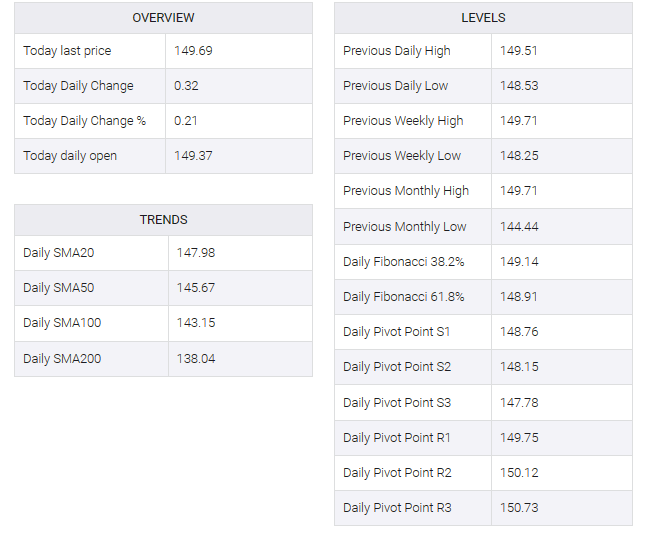

The USD/JPY pair hovers around 149.70 after retreating from the 11-month highs of 149.82 during the early European trading session on Monday. The renewed US Dollar (USD) broadly boosts the major pair ahead of the US ISM PMI due later on Monday. However, traders might turn cautious amid the fear of possible FX intervention by Japanese authorities.

Broadly boosts the higher greenback for a longer description in the US. Meanwhile, the US Dollar Index (DXY), a measure of the USD’s value against a basket of foreign currencies, resumed its upward trajectory, climbing to 106.28, its highest since November last year. Federal Reserve (Fed) Bank of New York President John Williams said on Friday that the central bank is at or near peak for the federal funds rate, noting that the Fed will need a tighter policy stance for some time to achieve the target, while Fed Bank of Richmond President Thomas Barkin said the central bank was on hold at September’s FOMC meeting and the Fed has time to watch the data before deciding what to do next on rates.

On Friday, the Personal Consumption Expenditures (PCE) price index rose 3.5% YoY in August, up from 3.4% in July, meeting market expectations. Meanwhile, the annual core PCE price index, the Federal Reserve’s preferred inflation gauge, rose to 3.9% from 4.3% in July, in line with expectations.

On a monthly basis, the PCE Price Index and Core PCE Price Index rose 0.4% and 0.1% MoM respectively. Both these figures fell short of what experts had expected. Additionally, personal income and personal expenditure rose 0.4% on a monthly basis, in line with expectations.

Market players will take cues from Fed Chair Jerome Powell’s speech at the US session on Monday. Dovish comments from officials could boost the US dollar (USD) and act as a tailwind for the USD/JPY pair. However, possible FX intervention by Japanese authorities could warn traders away from bullish bets as the pair trades near the 150.00 level, a psychological round mark and the BoJ intervened in the market last year.

Early Monday, Japanese Finance Minister Shunichi Suzuki continued his verbal intervention. Suzuki said it was watching currency movements “cautiously”. BoJ Governor Kazuo Ueda said on Saturday that the BoJ had “a long way to go” before exiting ultra-loose monetary policy. According to the BoJ summary of views at the monetary policy meeting on September 21 and 22, the BOJ said it did not need to make additional changes to the YCC because long-term rates were holding fairly steady and said the end of negative rates should be linked to success in achieving the 2% inflation target.

Market participants will monitor the US ISM manufacturing PMI for September on Monday, followed by Fed Chair Powell’s speech. Later this week, US ADP employment changes and ISM services PMI for September will be released on Wednesday. Friday will focus on US nonfarm payrolls. These events can give a clear direction to the USD/JPY pair.