-

AUD/USD fails to extend upside above 0.6380 as the focus shifts to US labor market data.

-

The US labor demand is seen softening considering the ADP Employment Change data.

-

AUD/USD faces selling pressure after testing the breakdown of the consolidation formed in a range of 0.6366-0.6522.

The AUD/USD pair faces selling pressure near 0.6380 while trying to extend the recovery in the first session in New York. Aussie assets are struggling to extend the recovery as the US dollar finds a cushion near 106.50 after correcting from an 11-month high of 107.35.

The US dollar is expected to remain volatile ahead of US nonfarm payrolls (NFP) data, due out on Friday. Labor demand appears to be softening considering the ADP employment changes data released on Wednesday, which showed private payrolls in September halved to 89K from the previous release of 180K.

Meanwhile, the US Department of Labor said weekly jobless claims data for the week ended September 29 was unchanged at about 207K.

On the Australian dollar front, the monthly trade balance data rose significantly to 9,640M, up from 8,725M and the previous release of 7,324M.

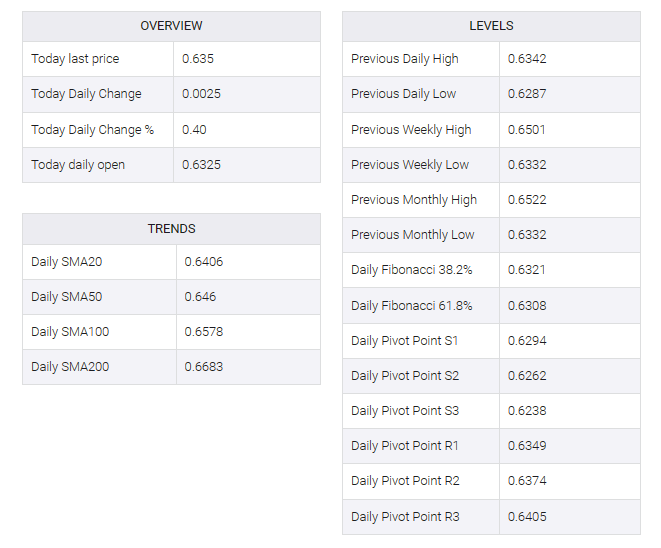

AUD/USD faced selling pressure after testing the breakdown of the consolidation formed in the 0.6366-0.6522 range on the daily scale. The 50-day exponential moving average (EMA) at 0.6464 continues to act as a barrier for Australian dollar bulls.

A bearish impulse would trigger if the Relative Strength Index (RSI) (14) shifts into the bearish range of 20.00-40.00.

A fresh downside would appear if the Aussie asset drops below October 03 low around 0.6286. This would expose the asset to 21 October 2022 low at 0.6212, followed by 13 October 2022 low at 0.6170.

In an alternate scenario, a decisive break above August 15 high around 0.6522 will drive the asset to August 9 high at 0.6571. Breach of the latter will drive the asset towards August 10 high at 0.6616.