-

EUR/GBP snaps the losing streak despite the downbeat economic data from the UK.

-

Euro faces a challenge as the ECB is expected to keep interest rates unchanged in the upcoming meeting.

-

ECB’s Yannis stated that there is little benefit in accelerating the conclusion of the PEPP.

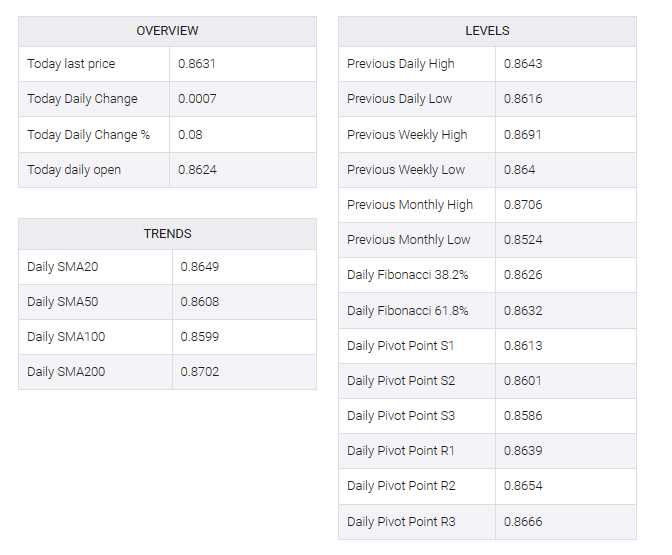

EUR/GBP halts the losing streak that began on October 3, trading in the green zone around 0.8630 during the European session on Thursday. The pair receives upward support despite the downbeat economic data from the United Kingdom (UK).

Industrial production (MoM) fell 0.7% in August, beating expectations for a 0.2% decline. The previous reading was negative by 1.1%. Manufacturing production fell 0.8% month-over-month, compared with a 0.4% decline in July and market consensus of a 1.2% decline.

Bank of England (BoE) policymakers are facing challenges ahead of November’s interest rate decision as a general slowdown in demand and output looms on the horizon.

The BoE’s Catherine Mann has been a staunch advocate of tightening policy to bring inflation under control and in line with the 2% target. Conversely, another central bank figure, Swati Dhingra, favors the idea of cutting rates if growth rates are unexpectedly lower than expected.

On the downside, there is speculation that the EUR/GBP pair may face additional hurdles, with the prevailing view that the European Central Bank (ECB) is currently shrugging off the possibility of further rate hikes.

European Central Bank (ECB) policymaker Yannis Stournaras stressed the importance of not prematurely ending the bond-buying initiative within the European Central Bank’s emergency program.

ECB Yannis highlighted that there is little benefit in accelerating the end of the Pandemic Emergency Purchase Program (PEPP), especially given the new uncertainty arising from the events in Israel and Palestine. Policymakers emphasize the need to maintain flexibility and be prepared to act when deemed necessary.

The EUR/GBP pair is facing downward pressure as ECB Governing Council member and Bank of France President Francois Villeroy de Galhau considers monetary policy to be sufficiently restrictive.

Villeroy cautioned against additional policy tightening, stressing that this is not the appropriate move, especially in the current context of tensions in the Middle East that contribute to a positive outlook for oil prices.

Market participants will likely watch the ECB Monetary Policy Meeting Accounts on Thursday, seeking an overview of economic and monetary developments. Additionally, ECB’s President Christine Lagarde’s speech will be eyed on Friday.