-

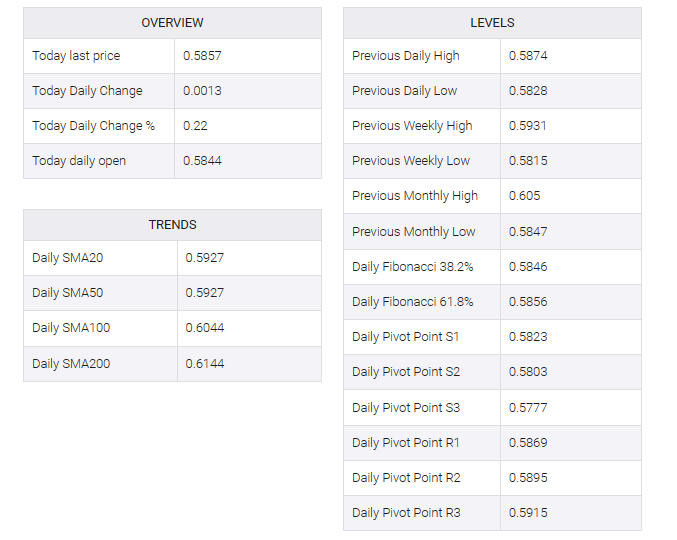

NZD/USD maintains a position above 0.5850 despite the upbeat US Dollar.

-

Israel’s delay in the ground assault plan in Gaza contributes support to the risk-on sentiment.

-

China’s updates appear to be influencing market sentiment positively.

-

US Dollar received upward support on stronger PMI figures.

NZD/USD retraces recent losses, trading at around 0.5860 during the Asian session on Wednesday. The uptick is influenced by improved risk sentiment, with the postponement of Israel’s ground assault plan in Gaza contributing support to the pair.

Moreover, the optimistic outlook is further bolstered by China’s intention to issue additional sovereign debt. Additionally, constructive dialogue between the United States and China contributed to the positive sentiment at their initial Economic Working Group meeting.

However, the NZD/USD pair may face challenges as the situation in the Middle East has created unease among investors due to the possibility of escalation, which could lead to disruptions in the region. Moreover, diplomatic efforts to de-escalate the Israel-Hamas conflict in the Gaza Strip are actively underway.

The US dollar index (DXY) rebounded from monthly lows, settling near 106.20 on the back of upbeat preliminary S&P global PMI figures from the US released on Tuesday.

However, a decline in US Treasury yields could provide downward pressure for the US dollar (USD), with the 10-year yield standing at 4.81%.

The US S&P Global Composite PMI showed gains in October, rising to 51.0 from 50.2. The services PMI also increased, reaching 50.9, and the manufacturing PMI rose to 50.0. It marked the first time in six months that manufacturing maintained a level above the 50-point threshold, indicating a positive shift in that sector.

Investors will likely watch US Q3 gross domestic product (GDP) on Thursday. US Core Personal Consumption Expenditures (PCE) and Kiwi’s ANZ – Roy Morgan Consumer Confidence will be watched on Friday.