-

USD/CAD advances on lower oil prices, US Dollar’s recovery, and neutral BoC bets.

-

The BoC is expected to keep interest rates unchanged at 5%.

-

USD/CAD hovers near the upper portion of the Rising Channel chart pattern in an attempt for a breakout.

The USD/CAD pair held on to gains through a breakout of consolidation formed in the 1.3665-1.3740 range in the European session. Loonie assets capitalize on expectations that the Bank of Canada (BoC) will keep interest rates unchanged at 5% for the second time in a row.

Apart from expectations of a BoC pause, a strong recovery in the US dollar after a pick-up in US business activity added strength to loonie assets. The US dollar recovered strongly on Tuesday after S&P Global reported higher manufacturing and services PMIs in October amid strong consumer spending despite higher interest rates by the Federal Reserve (Fed).

Oil prices corrected significantly as investors hoped the Israel-Hamas war could be contained. Several countries have called on Israel to reconsider the consequences of the ground attack on Gaza, which could cause a deep shock to the global economy. It is worth noting that Canada is the leading exporter of oil to the United States and lower oil prices affect the Canadian dollar.

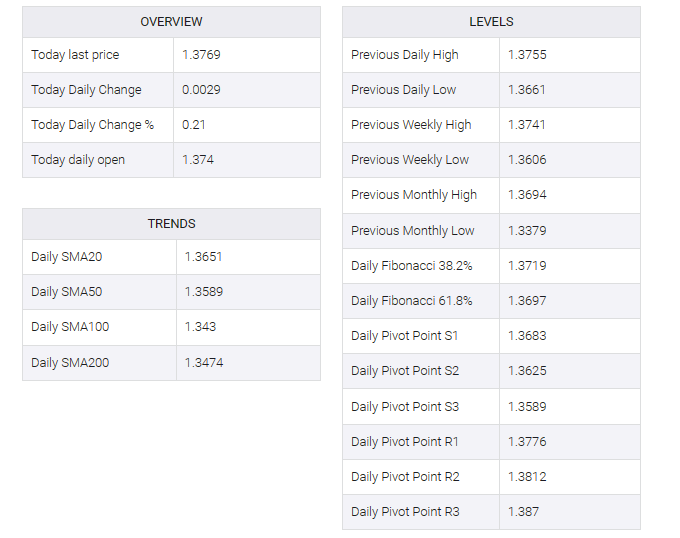

USD/CAD is hovering on the hourly scale in an attempt for a breakout near the top of the rising channel chart pattern. Looney assets reached the horizontal resistance plotted at the 1.3784 high from October 5. The upward-sloping 50-period exponential moving average (EMA) at 1.3720 warrants further upside.

The Relative Strength Index (RSI) (14) has moved into the bullish range of 60.00-80.00, indicating that upward momentum has begun.

A decisive break above March 24 high around 1.3800 would expose the asset to March 10 high at 1.3860, followed by the round-level resistance at 1.3900.

In an alternate scenario, a breakdown below September 25 low around 1.3450 would drag the asset toward September 20 low near 1.3400. A further breakdown could expose the asset to six-week low near 1.3356.