-

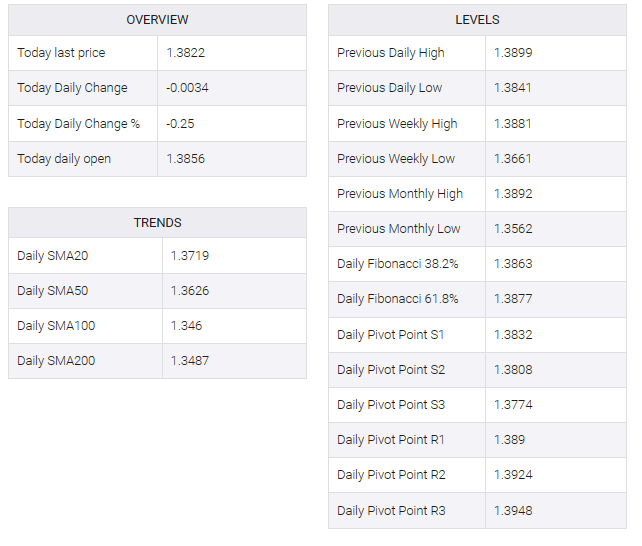

USD/CAD falls sharply to near 1.3800 as the US Dollar tumbles amid steady Fed policy.

-

The USD Index drops to near 106.16 as investors see the Fed done with hiking interest rates.

-

Investors await the US and Canadian Employment data for further guidance.

The USD/CAD pair fell vertically after a brief pullback near 1.3850 in the European session. Loonie assets faced a sharp sell-off as downside expectations for the US dollar widened as the Federal Reserve (Fed) raised interest rates for now.

S&P500 futures generated significant gains in the London session, illustrating a modest improvement in market participants’ risk appetite. US equities were heavily bought on Wednesday as the Fed kept interest rates unchanged in the 5.25-5.50% range. Fed Chair Jerome Powell played down expectations of further policy-tightening as the US economy remains resilient due to strong consumer spending and tight labor market conditions.

The US dollar index (DXY) extended toward a range near 106.16 after a gap-down opening, weighed down by steady Fed policy and a surprise ISM manufacturing PMI for October down. The US ISM reported that factory activity fell to 46.7 against expectations and previously published 49.0. In contrast, the S&P Global survey of private factories showed that manufacturing PMI met the 50.0 threshold in October.

Meanwhile, investors await US Nonfarm Payrolls (NFP) data, due out on Friday. As expected, US employers hired 180,000 jobseekers in October.

On the Canadian Dollar front, the Employment data for October will be keenly watched, which will be released on Friday. The Unemployment Rate is seen rising to 5.6% while 22.5K new labor joining are expected.