- GBP/USD moves further away from a multi-week top and is pressured by modest USD strength.

- The BoE’s bleak economic outlook undermines the GBP and contributes to the mildly offered tone.

- Investors now look to speeches by influential FOMC members before placing fresh directional bets.

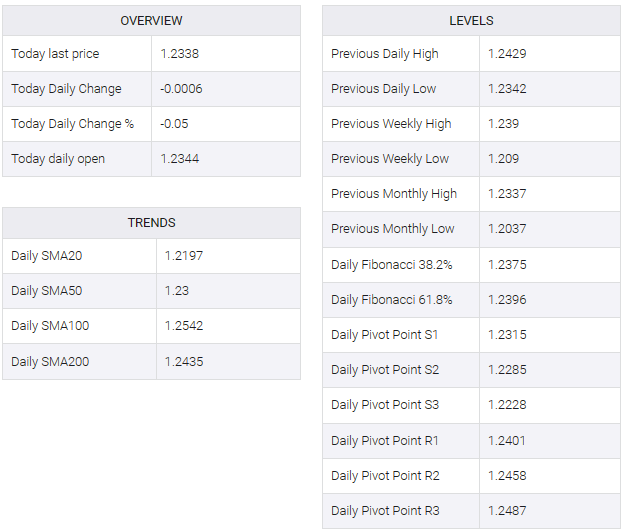

The GBP/USD pair trades with a negative bias for the second straight day on Tuesday and retreats further from its highest level since mid-September, around the 1.2425-1.2430 region touched the previous day. Spot prices drop to a two-day low, around the 1.2335-1.2330 zone during the Asian session, down less than 0.10% for the day, though lack follow-through selling.

The US dollar (USD) appears to be building momentum for an overnight recovery from a near eight-week low and this appears to be a key factor putting some pressure on the GBP/USD pair. Despite expectations that the Federal Reserve (Fed) is raising interest rates, less equivocal comments by FOMC members led to a nice rebound in US Treasury bond yields on Monday. Apart from this, a slight deterioration in global risk sentiment – as illustrated by a softer tone surrounding equity markets – underpins the safe-haven greenback.

The British Pound (GBP), on the other hand, has been weighed down by the Bank of England’s (BoE) bleak outlook, saying the UK economy is at risk of falling into recession next year. This, along with the previous day’s failure near the technically significant 200-day Simple Moving Average (SMA), prompted some selling near the GBP/USD pair and contributed to a milder suggested tone. However, the downside appears to be limited as traders wait for new indications about the Fed’s future rate hike path before positioning for the next phase of a directional move.

So, the focus will stick to speeches by influential FOMC members, including Fed Chair Jerome Powell’s appearances on Wednesday and Thursday. Meanwhile, a fresh leg down in US Treasury bond yields could put a lid on further gains for the buck and help limit downside for the GBP/USD pair. In the absence of any relevant market-moving economic data from the UK or US, the fundamental background makes it prudent to wait for strong follow-through selling before confirming that spot prices have topped out.