-

USD/JPY recovers sharply amid resilient US Dollar ahead of Powell’s speech.

-

Fed Bowman feels the requirement of one more interest rate increase.

-

A slowdown in Japan’s wage growth could delay BoJ’s plans of exiting from an easy policy stance.

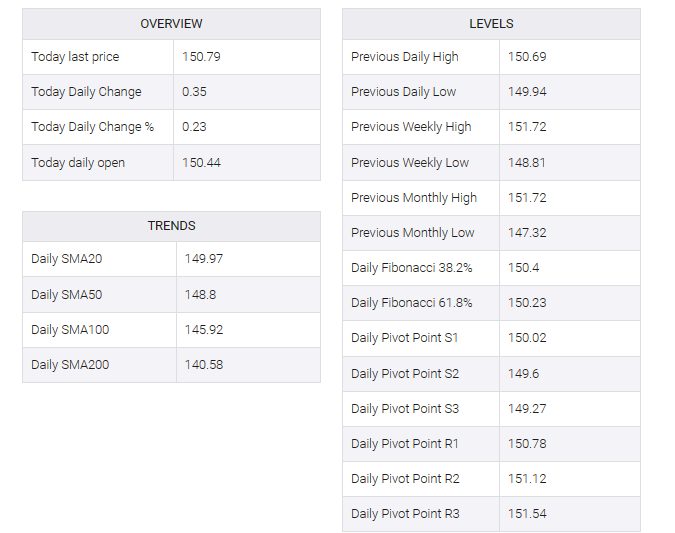

The USD/JPY pair has broken above immediate resistance at 150.70 and is expected to retake a two-week high near 151.50 amid US dollar strength. The asset continued to add gains as US dollar appeal improved ahead of Federal Reserve (Fed) Chair Jerome Powell’s speech.

S&P500 futures added nominal gains in the European session, illustrating a revival in risk appetite among market participants. The US dollar index (DXY) gained for a third straight trading session as Fed policymakers turned to more policy-making to ensure price stability is achieved. The 10-year US Treasury yield has recovered to around 4.58%.

US Fed Governor Michelle Bowman has announced support for further tightening of policy to ensure inflation returns to 2% on time. Bowman added that monetary policy appears to be constrained and some of the tightening of financial conditions has been contributed by higher bond yields, which could be volatile going forward.

While some Fed policymakers favor further interest rate hikes, investors still expect the central bank to act with interest rate hikes as the U.S. job market cracks. Manufacturing PMI remained below the 50.0 threshold and services PMI fell sharply in October.

On the Japanese Yen front, a decline in real wages has dampened the appeal of the Japanese Yen. Inflation-adjusted real wages dropped in September by 2.4%, which is likely to build pressure on already vulnerable consumer spending. Higher wage growth is a prerequisite for the Bank of Japan (BoJ) to exit from the expansionary policy stance.