-

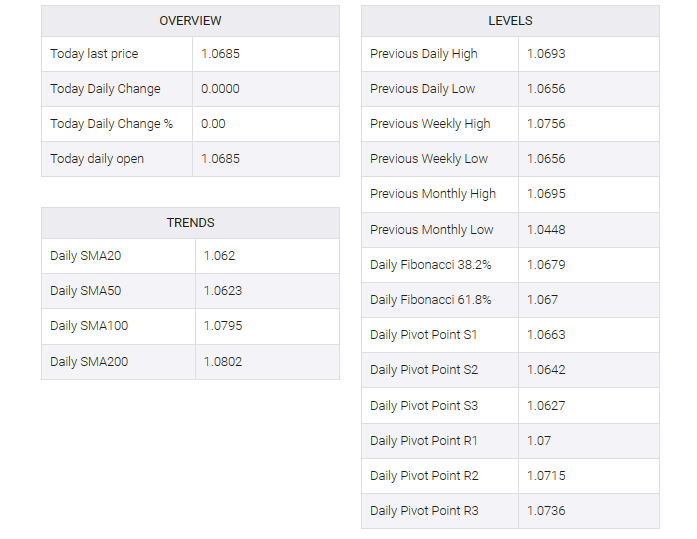

EUR/USD consolidates in a narrow trading range near 1.0685 on Monday.

-

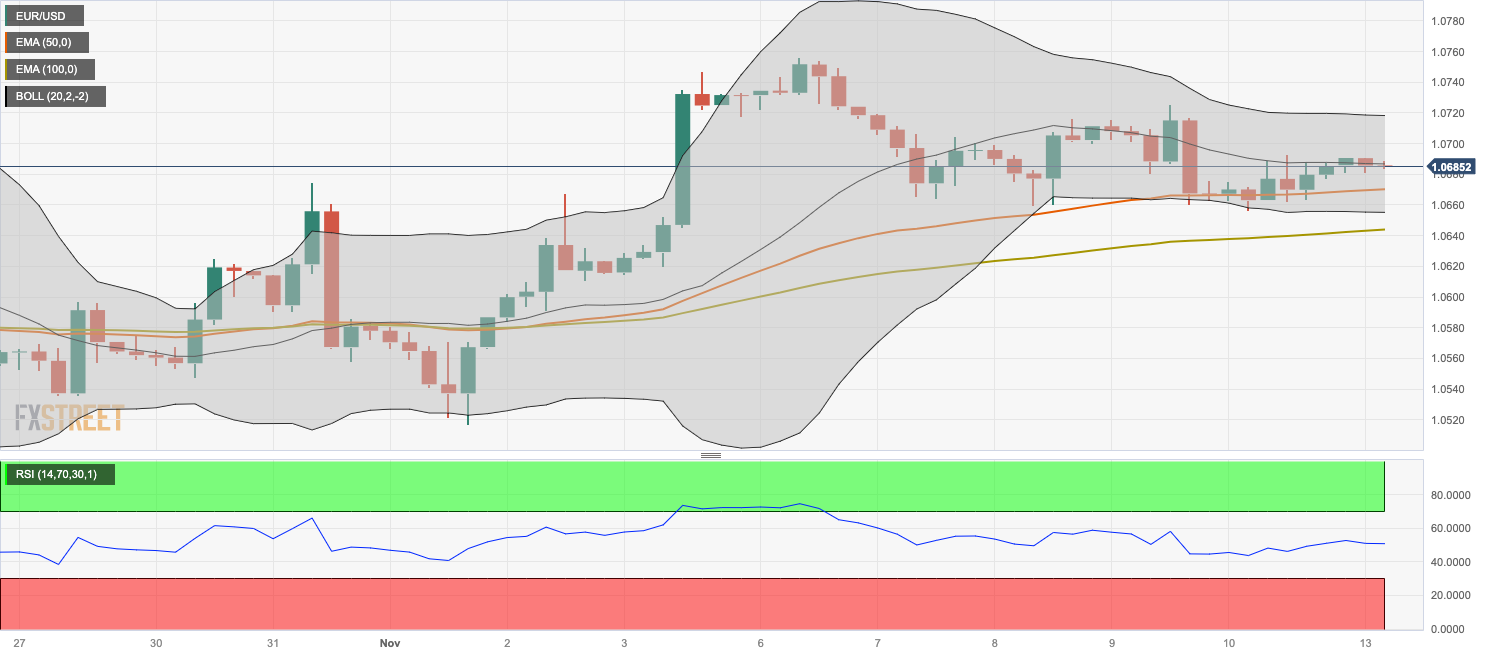

The pair holds above the 50- and 100-hour EMAs; the RSI indicator shows a non-directional movement.

-

The immediate resistance level is seen at 1.0718; 1.0655 acts as an initial support level.

The EUR/USD pair oscillated in a narrow trading range below the 1.0700 mark during Monday’s Asian session. Traders prefer to wait on the sidelines ahead of Eurozone gross domestic product for the third quarter (Q3). Quarterly growth numbers in the eurozone are expected to contract by 0.1%, while the annual figure is forecast to rise 0.1%. The soft report could weigh on the Euro (EUR) and act as a headwind for the pair. The major pair is currently trading around 1.0685, unchanged for the day.

From a technical perspective, EUR/USD is above the 50- and 100-hour exponential moving averages (EMAs) on the four-hour chart, supporting buyers for now. However, the Relative Strength Index (RSI) is located in the 40-60 zone, indicating a non-directional movement in the major pair.

The immediate resistance level for EUR/USD is seen at the upper boundary of the Bollinger Band at 1.0718. Any follow-through buy above the latter would see the next hurdle near the November 6 high at 1.0756. The additional upside filter to watch is near the psychological round figure at 1.0800.

On the other hand, the lower limit of the Bollinger Band at 1.0655 acts as an initial support level for the major pair. A break below 1.0655 will see a drop to the 100-hour EMA at 1.0644. Further south, the next contention level is located near a low of November 2 at 1.0591, followed by a low of November 1 at 1.0517.