-

GBP/USD strengthens ahead of inflation data from both economies.

-

UK GDP data showed better figures than expected, suggesting to avoid a recession in 2023.

-

Fed Chair Powell surprised with a more hawkish stance than expected, highlighting concerns that the current policies are not enough.

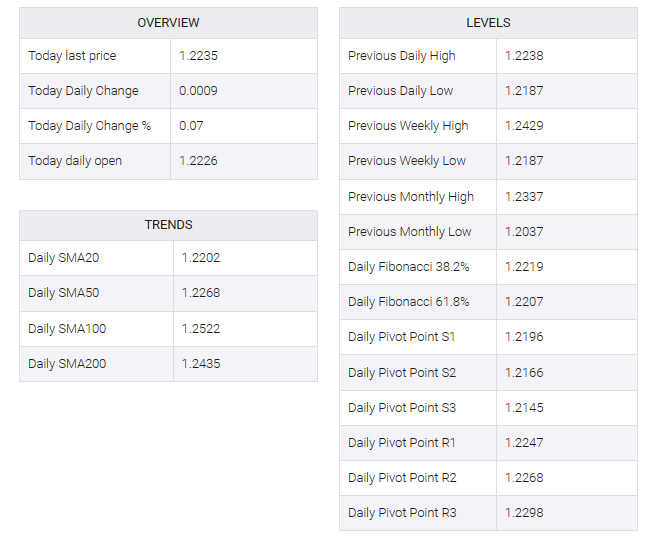

GBP/USD extended its gains for a second straight day, trading higher near 1.2230 during the Asian session on Monday. The GBP/USD pair received upward support from better-than-expected preliminary Gross Domestic Product (GDP) data from the United Kingdom (UK) released on Friday, along with a weaker US Dollar (USD).

UK GDP for the third quarter fell to 0.0%, compared to market consensus of a 0.1% contraction. On an annual basis, GDP remained consistent at 0.6% growth, missing the 0.5% estimate. These figures could improve market sentiment for the Pound Sterling (GBP).

Although data suggests the UK looks set to avoid recession in 2023, it remains on the brink of a stagnation situation. Inflation remains at higher levels, along with high unemployment rates. Hard times for economic balance.

Federal Reserve (Fed) Chair Jerome Powell spiced things up in his Thursday speech, surprising with a more dovish stance than expected. Concerns lingered as he expressed concern that current policies were not doing enough to adjust inflation towards the desired 2.0% target.

But Friday brought new twists for the US dollar (USD). Preliminary US Michigan consumer sentiment data took center stage, with consumer sentiment falling to 60.4 in November from 63.8 in the previous month.

GBP/USD traders are gearing up for a significant week ahead with a focus on the UK economic docket set for the release of employment and inflation data on Tuesday. Meanwhile, on the US front, all eyes in currency markets will likely be on the US Consumer Price Index (CPI) on the same day.