-

NZD/USD continues the downward trajectory for more than a week.

-

NZD faces downward pressure as New Zealand’s Food Price Index fell 0.9% in October.

-

Goldman Sachs anticipates the RBNZ to commence rate cuts starting in the fourth quarter of 2024.

-

US inflation could grow but at a slower pace, which could put pressure on the US Dollar.

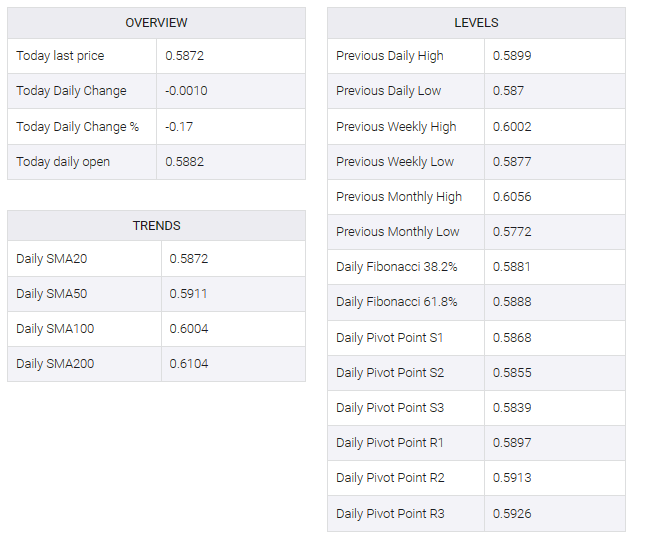

NZD/USD continued the downtrend that began on November 6, falling near 0.5870 in the Asian session on Tuesday. The New Zealand Dollar (NZD) faces downward pressure, likely due to the Kiwi Food Price Index (FPI) which recorded a 0.9% (MoM) decline in October.

With food prices constituting about 19% of the NZ Consumer Price Index, the FPI is significant as an indicator of the country’s inflation. It tracks the prices of a basket of food items representing typical New Zealand household spending patterns.

Goldman Sachs expects New Zealand’s CPI rate to fall below 3.0% by Q4 2024. There is an expectation in the forecast that the Reserve Bank of New Zealand’s (RBNZ) rate hike cycle is now complete, and Goldman Sachs expects the RBNZ to begin rate cuts starting in Q4 2024.

The US Dollar Index (DXY) faced challenges as it struggled to pare losses, bidding near 105.70. The greenback could face headwinds from volatile US bond yields. The 10-year US Treasury bond yield navigated a narrow range, standing at 4.63% at press time.

The market anticipates a rise in the US Consumer Price Index (CPI) for October, but at a slower pace. Simultaneously, the forecast for the core annual rate remains stable. If the actual data aligns with these expectations, it could solidify the market’s belief that the Federal Reserve (Fed) has concluded its interest rate hikes. This, in turn, could reinforce the downward pressure on the US Dollar (USD).