-

GBP/USD recorded a notable surge of 1.79% in the last trading session.

-

US CPI eased at 3.2% from 3.7%; Core CPI rose 0.2% against the expected 0.3%.

-

BoE may hold off on making any policy adjustments if UK inflation follows the anticipated slowdown.

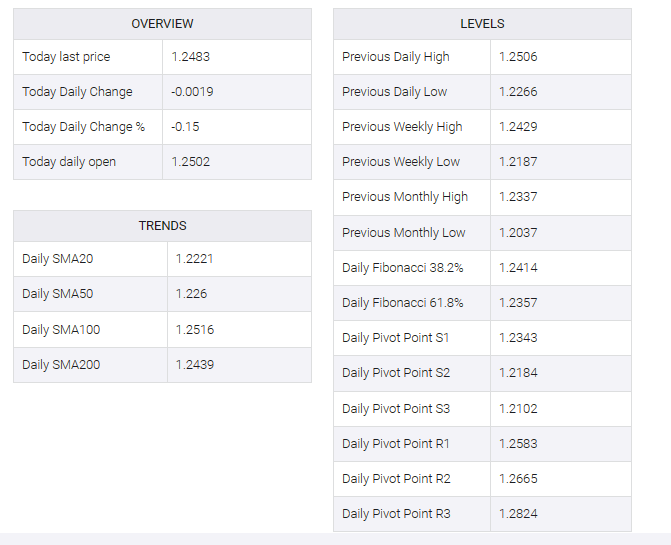

GBP/USD floats around 1.2480 during the Asian session on Wednesday. The GBP/USD pair saw a notable surge of 1.79%, reaching the 1.2500 zone following the release of weaker US inflation data overnight.

The US Consumer Price Index (CPI) for October released a lower-than-expected reading, with the annual rate falling to 3.2% from 3.7%, below the consensus forecast of 3.3%. The monthly CPI also fell to 0.0% from 0.4%.

In terms of US core CPI, it rose 0.2% below expectations of 0.3% and the annual rate fell to 4.0% from 4.1% previously.

The Dollar Index (DXY) hovered around 104.10 at the time of writing, following significant losses recorded in the previous session. The index fell 1.50%, hitting its lowest level since early September.

The US dollar (USD) has found itself under additional pressure due to increased risk appetite and a downward trend in US Treasury bonds. The US 10-year yield fell sharply, hitting an eight-week low of 4.43%.

On Tuesday, the GBP/USD pair witnessed strength following mixed employment data from the United Kingdom (UK). UK claimant count change fell to 17.8K in October compared to 20.4K previously The claimant count rate has been maintained at 4.0%. Employment changes fell to 207K in September from a decline of 82K previously. Furthermore, the UK’s ILO unemployment rate (3M) was steady at 4.2% in September.

Wednesday is set to bring key UK inflation data and retail sales figures. Markets will be watching these numbers closely and if inflation follows the expected downward trend, it could prevent the Bank of England (BoE) from making any immediate changes to its monetary policy.