-

USD/CAD extends its downside to 1.3700 on the weaker USD.

-

The bearish outlook for USD/CAD remains intact below the 50- and 100-day EMAs.

-

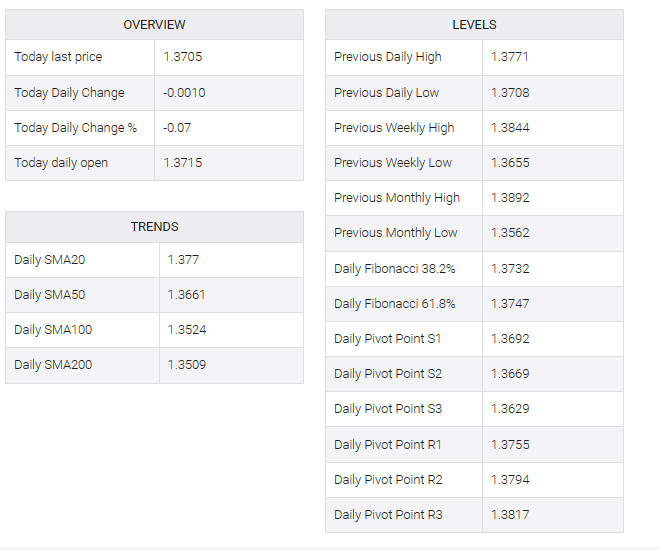

The first upside barrier will emerge at 1.3745; the critical support level is seen at 1.3655.

The USD/CAD pair lost momentum around 1.3700 during the early European session on Monday. A recovery in oil prices lifted the commodity-linked loonie, as the country is the top oil exporter to the US. Meanwhile, the US Dollar Index (DXY) fell to 103.70, its lowest since mid-July. Market players await the Federal Open Market Committee (FOMC) meeting minutes and Canadian inflation data for fresh stimulus on Tuesday. The annual and monthly Canadian Consumer Price Index (CPI) is expected to increase by 3.2% and 0.1% respectively.

Technically, the bearish outlook for USD/CAD remains intact as the pair remains below the 50- and 100-day exponential moving averages (EMAs) on the four-hour chart. Additionally, the Relative Strength Index (RSI) is in bearish territory below 50, which means USD/CAD’s path of least resistance is to the downside.

An immediate resistance level for the pair will emerge near the 100-EMA at 1.3745. The next hurdle to watch is near the upper boundary of the Bollinger Band at 1.3771. Any decisive follow-through buying above the latter would see a rally to the November 14 high at 1.3843, en route to the October 27 high at 1.3880.

On the other hand, the critical support level is seen at 1.3655. The mentioned level is the confluence of the lower limit of the Bollinger Band and a low of November 15. The next contention level is located near a low of November 6 at 1.3629. A break below the latter will see a drop to the 1.3600-1.3605 zone, portraying the psychological round mark and a low of October 16. The additional downside filter to watch is a low of October 12 at 1.3578.