-

USD/CHF halts a losing streak on the likelihood of further policy tightening by the Fed.

-

Nine-day EMA appears as the key barrier followed by the 0.8900 psychological level.

-

A break below the 0.8850 level could push the pair toward three-month lows.

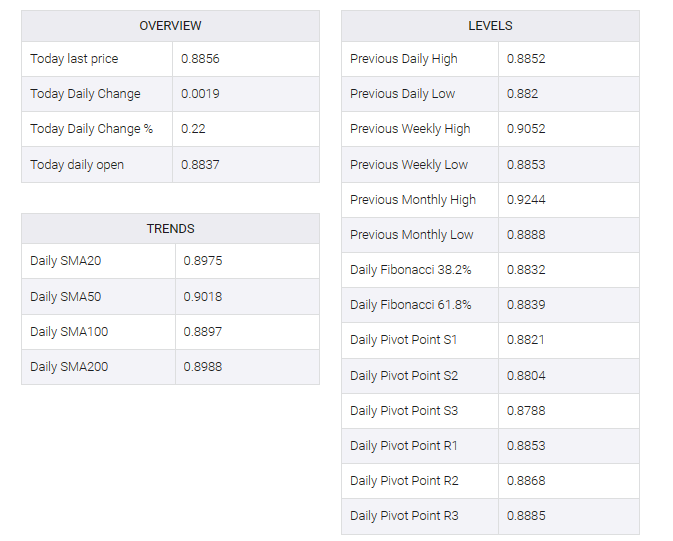

USD/CHF snaps a three-day losing streak, edging higher near 0.8860 during the European session on Wednesday. The nine-day Exponential Moving Average (EMA) at 0.8892 emerges as the resistance aligned up with the psychological region at the 0.8900 level.

A break above the latter could open the door for the USD/CHF pair to explore the next hurdle, following the 23.6% Fibonacci retracement at 0.8913 and the 0.8950 key level.

Federal Open Market Committee (FOMC) meeting minutes on Tuesday suggested that additional monetary policy tightening may be necessary if new data fails to reach the Federal Reserve’s (Fed) inflation target, which could cause the USD/CHF pair to gain strength. . Until there is clear and consistent progress towards the Committee’s inflation target, the Board decided to stick to its tough stance.

However, the technical indicators of the USD/CHF pair support the current downtrend. A 14-day relative strength index (RSI) below 50 indicates bearish sentiment, indicating that the pair is losing momentum.

Furthermore, the Moving Average Convergence Divergence (MACD) line is below the centerline, with divergence below the signal line, indicating that the USD/CHF pair could re-test the major support at the 0.8850 level. If there is a break below the level, the pair could navigate the area around the psychological level at 0.8800, nearing the three-month low at 0.8795.