-

USD/CAD attracts fresh buyers on Wednesday and draws support from a combination of factors.

-

Softer Canadian CPI undermines the Loonie and acts as a tailwind amid a modest USD strength.

-

The mixed technical setup warrants caution before positioning for a firm near-term direction.

The USD/CAD pair regains positive traction on Wednesday and holds its neck above the 1.3700 round-figure mark through the first half of the European session.

The Canadian dollar (CAD) was weakened by soft domestic consumer inflation data released on Tuesday, which now appears to have dashed hopes of any further rate hikes by the Bank of Canada (BOC). The US dollar (USD), on the other hand, appeared to build on the previous day’s hawkish FOMC minutes-inspired recovery action from its lowest level since August 31 and acted as a tailwind for the USD/CAD pair. Meanwhile, subdued crude oil prices around do little to provide any meaningful stimulus to the commodity-linked loonie.

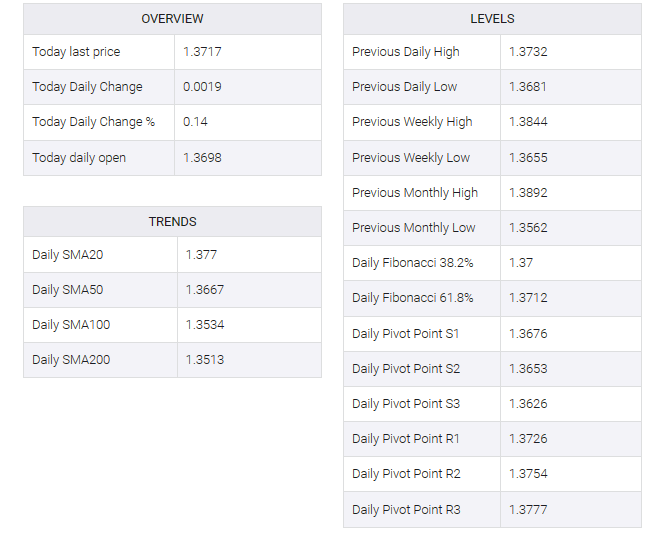

From a technical perspective, the spot price, so far, is showing resilience below the 38.2% Fibonacci retracement level of the September-November rally and has found some support near the two-month-old ascending trend line. The latter is close to the 50-day Simple Moving Average (SMA) around the 1.3670-1.3665 region, which will now act as a pivotal point and determine the near-term trajectory for the USD/CAD pair.

As oscillators start to gain some negative traction on the daily chart, a credible break below the 50-day SMA will be seen as a new trigger for bearish traders and pave the way for some meaningful downside. The USD/CAD pair could then further weaken below the 50% Fibo. level, around the 1.3640-1.3635 zone, and accelerate the slide towards the 1.3600 mark, or 61.8% Fibo, on the way to the 1.3580-1.3575 zone. layer

On the flip side, any subsequent move-up is likely to confront some resistance near the weekly swing high, around the 1.3750 area ahead of the 1.3775 region, or the 23.6% Fibo. level. Some follow-through buying will negate any near-term negative bias and allow the USD/CAD pair to reclaim the 1.3800 mark. The momentum could get extended further towards the 1.3835-1.3840 supply zone and the YTD peak, near the 1.3900 level.