-

GBP/USD gains ground as US Dollar retreats after two-day gains.

-

US Jobless Claims declined to 209K from 233K prior; the UoM Consumer Sentiment Index reached 61.3 instead of the projected 60.5.

-

UK Chancellor of the Exchequer, Jeremy Hunt outlined plans to reduce debt, cut taxes, and incentivize work.

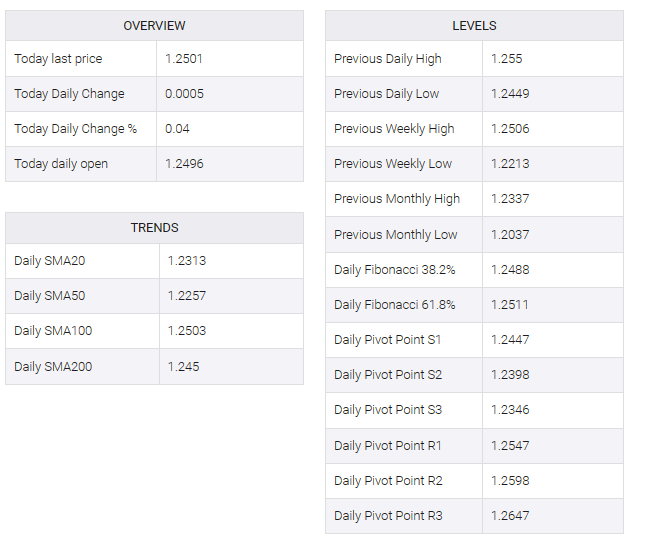

GBP/USD traded near 1.2500 in the Asian session on Thursday, after snapping its three-day winning streak in the previous session. The pair faced challenges in the previous session, influenced by a stronger US dollar (USD) following the release of economic data from the United States (US). Investors seem to be sensing continued inflation in the US, coupled with a sluggish economy.

The US dollar index (DXY) retreated after hitting gains for two consecutive days, bidding lower near 103.70 at the time of writing. The greenback continued its correction after the release of moderate US economic data but lost momentum amid higher equity prices.

Wednesday’s US jobless claims data indicated a bigger-than-expected decline for the week ended Nov. 17, with initial claims falling to 209K from 233K earlier. In addition, durable goods orders in October fell 5.4% compared to an expected 3.1%, experiencing a larger-than-expected decline. However, the University of Michigan Consumer Sentiment Index came in at 61.3 for November instead of the 60.5 expected.

Jeremy Hunt, UK Chancellor of the Exchequer, unveiled the Autumn Statement, outlining plans to reduce debt, cut taxes and boost work. He highlighted cooperation with the Bank of England (BoE) to achieve the 2.0% inflation target by 2025, as projected by the Office for Budget Responsibility (OBR). Despite expecting a positive impact on inflation and GDP, Hunt acknowledged a revised growth forecast, with GDP expected to grow by just 0.7%, down from the previous OBR estimate of 1.8% in March.

The preliminary S&P Global/CIPS Purchasing Managers Index (PMI) data for November in the United Kingdom is set to be released on Thursday. Additionally, US markets will be closed on Thursday for Thanksgiving Day. On Friday, the US will release the preliminary S&P Global Manufacturing and Services PMI for November, with expectations of a decline.