-

EUR/USD loses ground as US Dollar attempts to rebound.

-

Technical indicators suggest revisiting the major level at 1.0950 near the three-month high.

-

The nine-day EMA at 1.0867 could act as the key support followed by the major level at 1.0850.

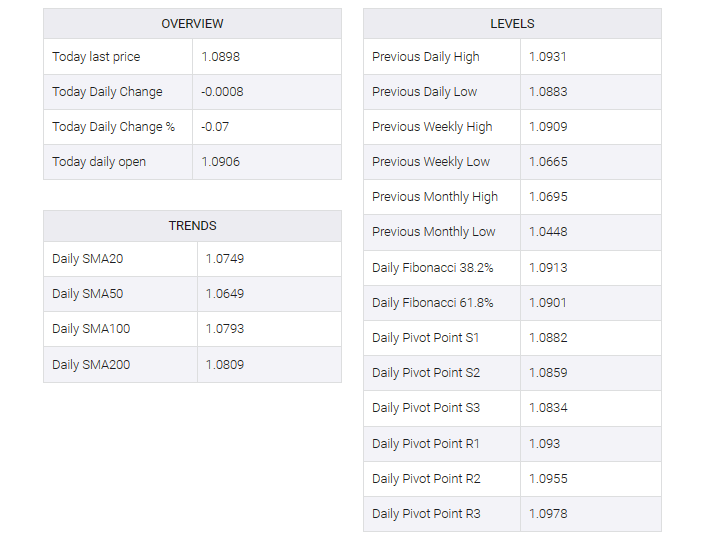

EUR/USD recovered recent gains, trading below the psychological barrier at the 1.0900 level during the Asian session on Friday. The euro’s weakness can be attributed to a stronger US dollar (USD). The greenback recovers on the back of improved US Treasury yields.

The nine-day exponential moving average (EMA) at 1.0867 appears to be the key support level aligned with the next major level at 1.0850. and 23.6% Fibonacci retracement at 1.0842. A decisive break below the support zone could push the EUR/USD pair to navigate the psychological level at 1.0800.

Technical indicators of the EUR/USD pair support the current uptrend. The 14-day relative strength index (RSI) above 50 indicates bullish sentiment, indicating that the pair may retest key levels at 1.0950, close to the three-month high at 1.0965. A move above the latter could support bulls in the EUR/USD pair to navigate the resistance area around the 1.1000 psychological level.

Furthermore, the Moving Average Convergence Divergence (MACD) line is above the centerline and the signal line, indicating a bullish momentum in the pair.