-

GBP/USD gains traction near 1.2540 ahead of the US PMI data.

-

The pair holds above the 50- and 100-hour EMA; the RSI indicator stands in bullish territory above 50.

-

1.2550 will be the first resistance level; the critical support level will emerge at 1.2525.

The GBP/USD pair hit a two-month high of 1.2575 and then bounced back to 1.2540 in Asian trading hours on Friday. The pair’s rise is supported by expected UK S&P Global/CIPS PMI data for November. Later on Friday, focus will shift to US S&P Global PMI data.

On Thursday, the preliminary UK S&P Global/CIPS Composite PMI rose unexpectedly in November, coming in at 50.1 in November from 48.7 in October, better than the 48.7 expected. Additionally, the manufacturing PMI improved to 46.7 from 44.8 previously, while the services PMI rose to 50.5 from 49.5 previously. The British Pound (GBP) rose against the US Dollar (USD) as Bank of England (BoE) Governor Andrew Bailey suggested that interest rates may hold longer than priced in by investors.

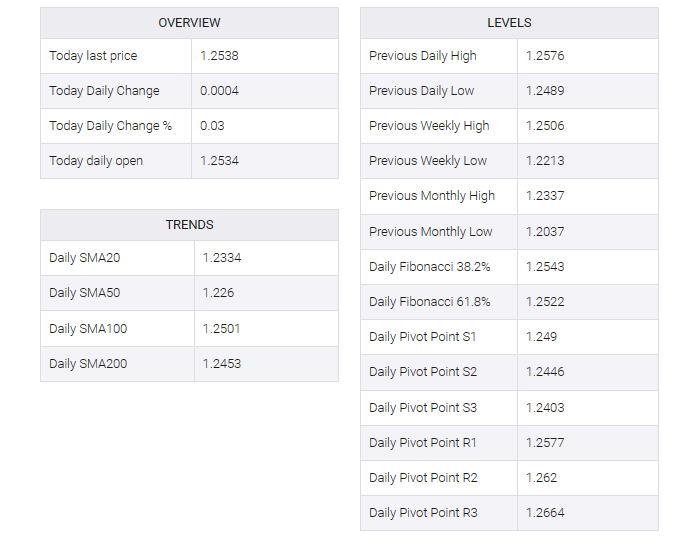

On the four-hour chart, GBP/USD is above the 50- and 100-hour exponential moving averages (EMAs), indicating the path of least resistance to the upside. The upper boundary of the Bollinger Band at 1.2550 will be the first resistance level for the pair. The next hurdle is seen near the November 23 high at 1.2575. Further north, the upside target to watch is the September 4 high of 1.2642, followed by the September 1 high of 1.2713.

On the downside, the key support level will emerge at 1.2525 depicting the confluence of the lower boundary of the Bollinger Bands and the 50-hour EMA. A break below the latter would pave the way for the 100-hour EMA and a psychological round mark in the 1.2500-1.2505 region. Any follow-through selling would lead to a drop to the November 16 high at 1.2456 and eventually 1.2400 (circular figure).

It’s worth noting that the Relative Strength Index (RSI) holds in the bullish territory above 50, indicating further upside looks favorable.

(This story was corrected on November 24 at 08:13 GMT to say, in the first paragraph, that the GBP/USD pair gained ground to a two-month high of 1.2575, not 1.2569.)