-

GBP/USD maintains its upward trajectory on a hawkish BoE tone.

-

BoE Governor Andrew Bailey mentioned the challenge of bringing inflation back to the 2% target.

-

US New Home Sales dropped by 5.6% at 679K against the market consensus of 725K in October.

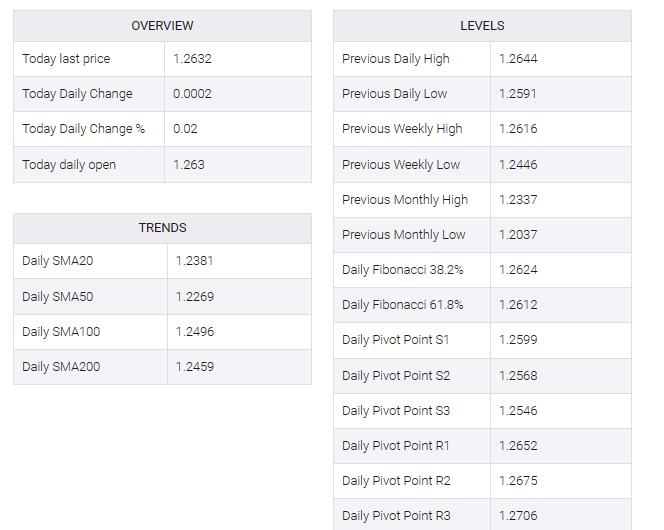

GBP/USD reached its highest level since early September, touching the 1.2644 level on Monday In the Asian session on Tuesday, the GBP/USD pair maintained its upward trajectory, trading around 1.2630. The pound sterling (GBP) remained firm against the US dollar (USD) for a fourth consecutive day, reflecting the resilience of the UK economy in the face of tightening measures by the Bank of England (BoE).

Bank of England Governor Andrew Bailey acknowledged the challenge of bringing inflation back to the 2% target, stressing that the recent decline was linked to a drop in energy prices from 6.7% to 4.6%. Bailey emphasized the need to reduce inflation, acknowledging the potential adverse impact on households, as higher prices could worsen the situation.

A related update was provided in the latest report from the United States (US) Census Bureau, which indicated a sharp decline in new home sales for October, attributed to higher mortgage rates. The data revealed a 5.6% drop, with sales coming in at 679,000, falling short of the market consensus of 725,000.

In terms of market expectations, money market futures suggest a 25 basis point rate cut expected by the BoE in September next year. In contrast, regarding the Federal Reserve (Fed), traders have fully factored in a cut of around 85 basis points in 2024.

Tuesday is set to feature a speech from BoE Deputy Governor for Markets and Banking, David Ramsden, drawing attention from investors. Meanwhile, in the US, crucial data such as the Housing Price Index and CB Consumer Confidence will be released. Additionally, several speeches from Federal Reserve (Fed) officials are on the agenda, offering valuable insights into the central bank’s outlook on the economic landscape.