-

USD/CAD struggles to hold ground as US Dollar rebounds.

-

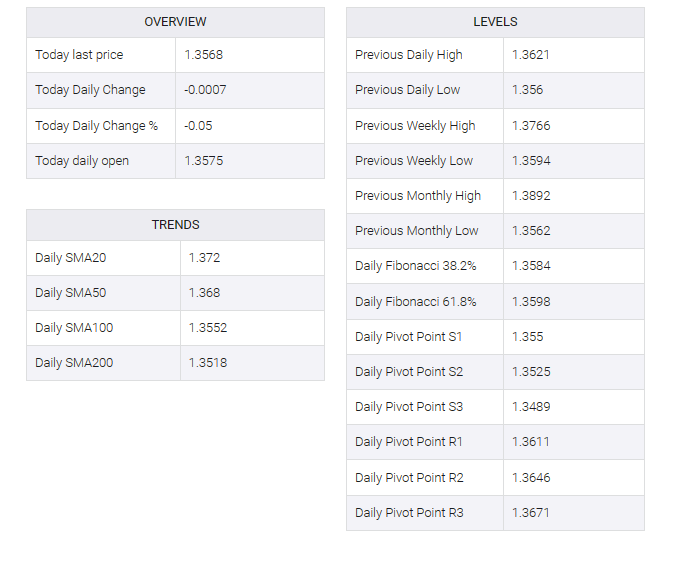

Technical indicators suggest retesting the major support at the 1.3550 level.

-

A break above the psychological barrier of 1.3600 could approach the 23.6% Fibo at 1.3625.

USD/CAD is struggling to halt its three-day losing streak post having recovered most of its intraday losses, hovering around 1.3570 during European hours on Wednesday. However, the USD/CAD pair faced challenges during the Asian session on the back of a softer US dollar (USD) and improvement in crude oil prices.

Technical indicators of the USD/CAD pair support the current downtrend. The moving average convergence divergence (MACD) line is below the centerline and signal line, indicating a bearish momentum in the pair.

Furthermore, the 14-day Relative Strength Index (RSI) below 50 indicates bearish sentiment, indicating that the USD/CAD pair may meet support near key levels at 1.3550.

A firm break below the latter could influence the bears of the USD/CAD pair to navigate to the psychological support zone near 1.3500.

On the upside, if the USD/CAD pair surpasses the psychological barrier of 1.3600, it could reach the 23.6% Fibonacci retracement at 1.3625 and seven-day Exponential Moving Average (EMA) at the 1.3628 level. A breakthrough above the resistance area could open the doors for the USD/CAD pair to explore the region around the 1.3650 level.