-

Pound bulls fail to extend beyond 1.2670.

-

UK Manufacturing PMI beats expectations in November.

-

The US Dollar ticks up with all eyes on Fed Powell.

Sterling’s rebound seen after the better-than-expected manufacturing data has been short-lived. Bulls have been capped at 1.2675, which leaves the pair in no man’s land with the near-term upside trend losing steam.

UK manufacturing data fails to boost the Pound

The UK S&P Global/CIPS manufacturing PMI rose to 47.2 in November, from 46.7 in October, missing expectations for a 46.6 reading. Earlier today Nationwide revealed that housing prices rose in November against expectations.

On the other hand, the US dollar is ticking off session lows, with the Tey mark bracing for several Fed speakers later today with particular interest in Fed Chairman Jerome Powell. It is weighted on GBP bulls.

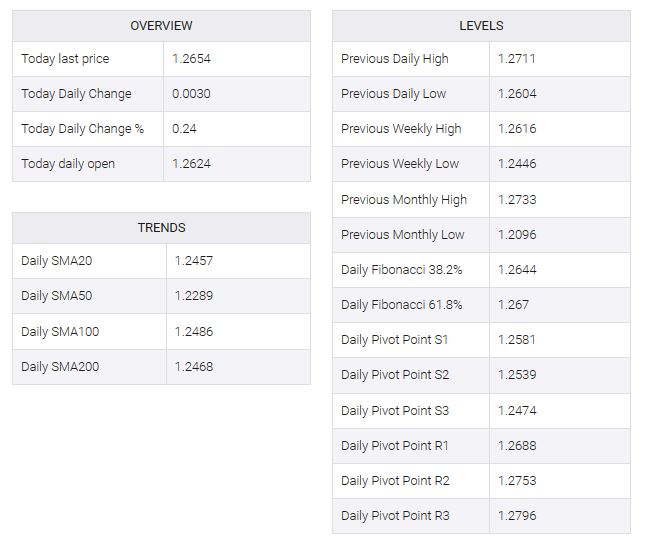

From a technical perspective, the near term remains positive yet price action shows hesitation below 1.2700. The “Evening Star” candle pattern on the daily chart suggests the possibility of a downside correction.

Immediate resistance from November high at 1.2627, at 1.2730. On the downside, the supports are 1.2590 and 1.2410

Technical levels to watch