-

The AUD/USD tallied modest gains, seeing action around the 0.6650 level.

-

The US reported mixed ISM PMIs. China’s PMIs were better than expected and tractioned the Aussie.

-

Investors will look for clues in Jerome Powell’s speech at Spelman College in Georgia.

In Friday’s trading session, the Australian Dollar (AUD) found demand against its US counterpart, with the AUD/USD pair gaining and trading at around 0.6650. The pair’s upward momentum appears to be China’s positive PMI figures, which improved in November. As the Chinese economy plays a large role in Australia’s economy, positive figures benefit Australia.

On the US side, for the 12th consecutive month, the US manufacturing sector experienced a contraction in economic activity in November. The ISM Manufacturing PMI remained unchanged at 46.7, below market expectations of 47.6. The focus is now on Jerome Powell’s lecture at 16 GMT and 19 GMT at two separate events hosted by Spelman College in Georgia.

In that sense, innovators will look for clues in the Federal Reserve (Fed) analysis of recent data released in the United States, which showed that the US Consumer Price and Personal Consumption Expenditure Index, two key measures of inflation for the bank, have declined in the past. months

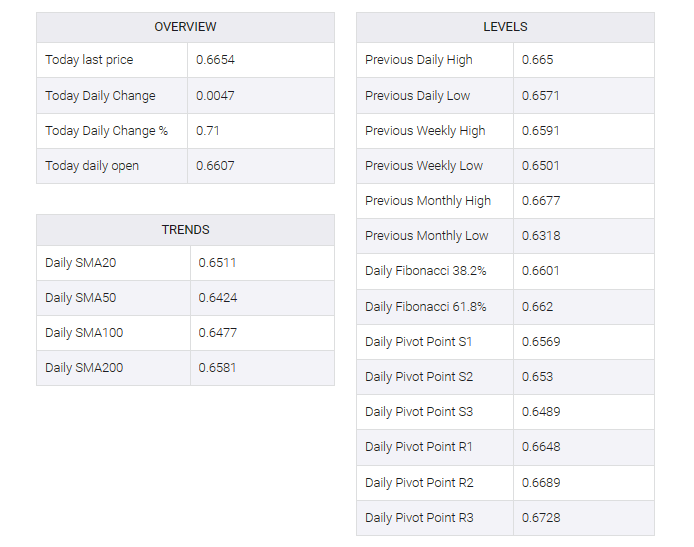

AUD/USD levels to watch

On the AUD/USD daily chart, it is evident that the buying momentum is dominating. The Relative Strength Index (RSI) is nearing overbought territory, while the histogram of the Moving Average Convergence Divergence (MACD) showcases rising green bars, reaffirming this buying trend.

Moreover, the AUD/USD is hovering above its 20, 100, and 200-day Simple Moving Averages (SMAs). This position is suggestive of sustained bullish momentum, as the pair is trading above these crucial markers, solidifying the control of the bulls on the broader scale.

Support Levels: 0.6600, 0.6580 (200-day SMA), 0.6500.

Resistance Levels: 0.6670, 0.6700, 0.6730.

AUD/USD daily chart