-

GBP/USD experiences a significant uptick, climbing 0.70% above the 1.2700 mark.

-

Federal Reserve Chairman Jerome Powell’s comments on restrictive monetary policy and high core inflation fail to bolster the US Dollar.

-

Market futures now anticipate over 130 basis points of rate cuts by the Fed in 2023, leading to a drop in US Treasury bond yields.

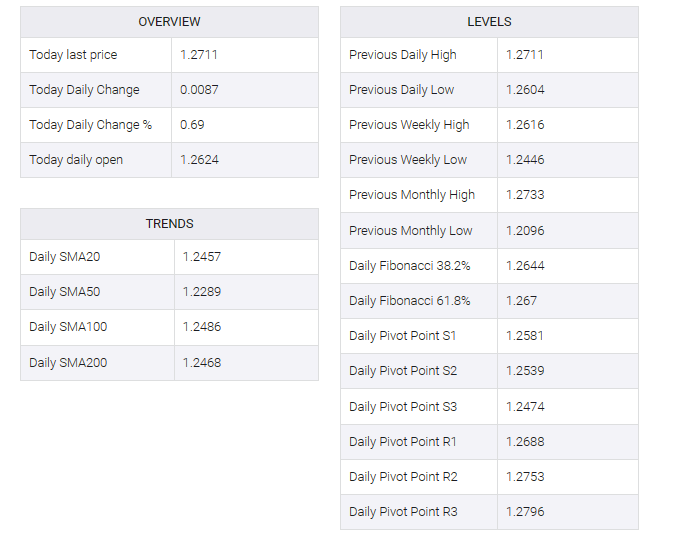

GBP/USD climbed more than 90 pips late during Friday’s North American session, or 0.70%, after reaching a daily low of 1.2609. Speculations that the Federal Reserve has finished its tightening cycle sparked more than 100 basis points of cuts by the Fed next year, a headwind for the Greenback. The pair is trading at 1.2711.

British Pound gains against the US Dollar, driven by market expectations of Federal Reserve rate cuts and dovish signals

A softer greenback is the main factor behind GBP/USD’s advance. Although US Federal Reserve Chairman Jerome Powell backed away from expectations of a rate cut, he was unable to move the index and boost the US dollar, as measured by the US Dollar Index, which measures the currency against six other peers, down 0.38%, to 103.12. .

Powell said that monetary policy is “good in a controlled area”, seen as a green light for investors who see risk, turning to high-beta currencies such as the British pound (GBP). At the same time, Wall Street pared its losses and rose late in the session. While he acknowledged that inflation is easing, he said core prices remain “very high”.

Money market futures see the federal funds rate (FFR) at around 4.11% by the end of next year, indicating a rate cut of more than 130 basis points. As a result, US Treasury bond yields declined, with the 2s and 10s each dropping more than ten basis points, to 4.56% and 4.22%, respectively.

On the data front, US manufacturing business activity has taken a toll for the thirteenth consecutive month, remaining in recession territory at 46.7, unchanged from October but below forecasts for an improvement to 47.6.

Across the Atlantic, the S&P Global Manufacturing PMI improved, although it remained in recession territory. In contrast, Bank of England (BoE) officials remain hawkish. Margaret Green said she saw signs of inflation stabilizing, as she said a “core” services inflation rate, excluding energy prices, sat at 6%, which could prevent the BoE from discussing rate cuts.

.

GBP/USD Price Analysis: Technical outlook

On Friday, the GBP/USD rise above the 1.2700 figure formed a bullish engulfing candle pattern, implying that bulls are in charge. Yet, to cement their case, they must breach the August 30 high of 1.2746 to threaten to challenge the 1.2800 figure. In that case, the pair would’ve broken two resistance levels, which could pave the way toward 1.3000. On the other hand, if the major stalls and achieves a daily close below 1.2700, that could keep the pair in consolidation within the 1.2600/1.2740ish range.