-

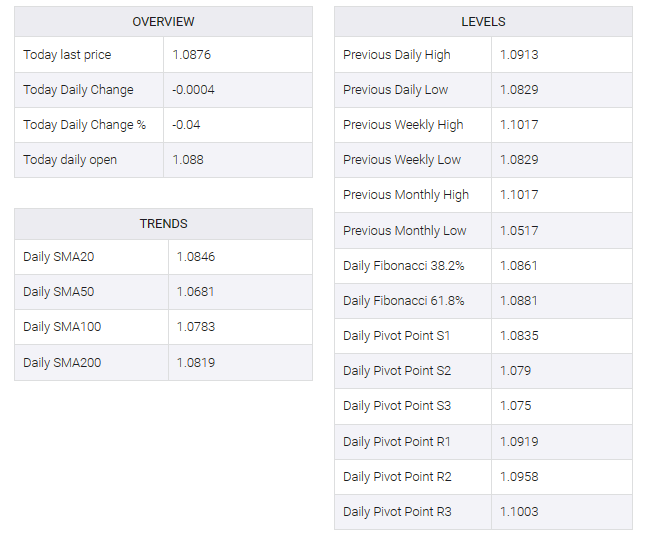

EUR/USD attracts some sellers under the 1.0900 psychological mark on Monday.

-

The bullish outlook of EUR/USD looks vulnerable; RSI indicator stands below the 50.0 midline.

-

The 1.0900–1.0910 zone acts as an immediate resistance level; the initial support level is seen at 1.0827.

The EUR/USD pair lost momentum in the early European session on Monday. Following surprisingly low inflation figures in major economies, traders are betting that the European Central Bank (ECB) will cut interest rates next year and begin a deeper easing cycle. The market is pricing in a 50% unfavorable rate in early March. This, in turn, exerts some selling pressure on the Euro (EUR). At press time, EUR/USD is trading near 1.0874, down 0.07% on the day.

According to the four-hour chart, the bullish outlook for EUR/USD looks weak as the major pair hovers around the 100-hour exponential moving average (EMA). A decisive break below the latter would reaffirm the bearish outlook. Additionally, the Relative Strength Index (RSI) stands below the 50.0 midline, indicating that a further downside cannot be ruled out for now.

The 1.0900–1.0910 zone serves as an immediate resistance level for EUR/USD. The mentioned level is the confluence of the 50-hour EMA and a psychological figure. The next resistance is seen at the November 21 high at 1.0965. Any follow-through buy above the latter would show the next upside barrier near the upper boundary of the Bollinger Band and a round mark at 1.1000.

On the flip side, the lower limit of the Bollinger Band at 1.0827 will be the initial support level. The additional downside filter to watch is a high of November 6 at 1.0755, followed by a low of November 9 at 1.0660.