-

The Pound trades sideways after failing to break 1.2730.

-

Traders are cautious ahead of a string of key US data this week.

-

The broader positive trend remains intact.

The pound is moving sideways on Monday without a clear direction after failing to extend gains above 1.2760 amid a slightly stronger US dollar.

Investors were more cautious on Monday after witnessing a risky rally on Friday. With a string of U.S. indexes ahead, investors are looking for more data to assess the Fed’s next moves, ending with Friday’s nonfarm payrolls report.

Beyond that, the deteriorating situation in the Middle East, news of attacks on two commercial ships in the Red Sea further dampened risk appetite.

The main event on the calendar today will be US factory orders. On Tuesday, the focus will be on UK and US services PMIs, and US job openings, the first of several US employment indicators.

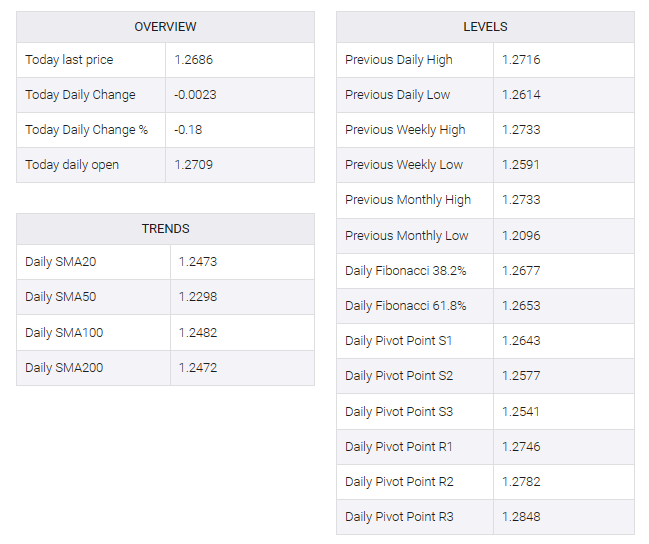

From a technical point of view, the pair maintains a broad upside trend with resistance at 1,2730 closing the way towards 1.2820 and 1.2900. The supports are 1.2600 and 1.2480