-

AUD/USD struggles to gain ground near 0.6550 on the firmer USD.

-

US ADP private payrolls rose 103K in November vs. 106K prior, weaker than expected.

-

The weaker Australian growth number supports the expectation that the RBA will hold the cash rate at 4.35% for some time.

-

Australia’s Building Permits and Trade Data for October will be due on Tuesday ahead of the US weekly Jobless Claims data.

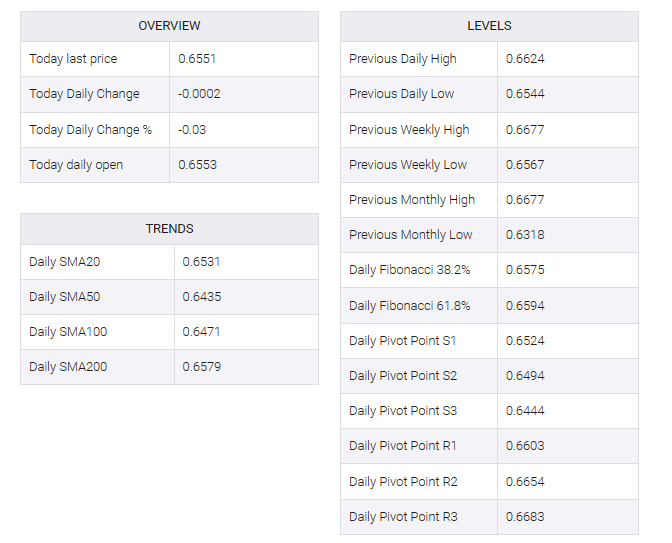

The AUD/USD pair surrendered gains and moved closer to 0.6550 in the early Asian session on Thursday. Meanwhile, the US Dollar Index (DXY) extended its gains above 104.15 despite lower US Treasury bond yields and weaker US economic data. The pair is currently trading near 0.6551, up 0.01% on the day.

On Wednesday, US ADP private payrolls rose to 103K in November from a downwardly revised 106K in October, worse than expectations for 130K. The report suggests that the pace of employment in the United States has slowed. Traders will take further cues from weekly jobless claims ahead of the highly anticipated nonfarm payrolls (NFP).

On the other hand, third quarter (Q3) Australian gross domestic product (GDP) rose 0.2% QoQ, below the market consensus of a 0.4% expansion. On an annualized basis, the growth number came in stronger than expected, rising to 2.1% YoY from the previous reading of 2.0%. The slowdown in GDP growth in the last two quarters indicates a broader weakness in the economy at the expected-expected rate of expansion. The report supports expectations that the Reserve Bank of Australia (RBA) will keep the cash rate at 4.35% for some time.

Australia’s Building Permits and Trade Data for October will be released on Thursday. Later in the day, the US weekly Jobless Claims data will be the highlight. These data could give a clear direction to the AUD/USD pair.