-

EUR/USD rebounded from its three-week low at 1.0723.

-

ECB is expected to keep the Main Refinancing Operations Rate unchanged at 4.5% in its upcoming meeting.

-

Fed may maintain interest rates at 5.5% during the policy meeting on Wednesday.

-

Solid US labor data triggered the discussion on the duration of tightened monetary policy by the Fed.

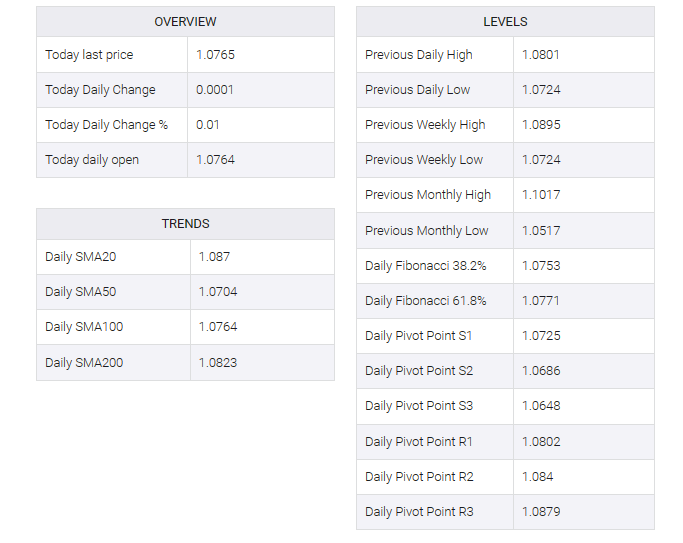

EUR/USD rebounded from its three-week low of 1.0723, recorded on Friday. The EUR/USD pair traded higher near 1.0760 during Asian trading hours on Monday. However, the US dollar (USD) gained an upward momentum following the release of strong economic data from the United States (US).

US non-farm payrolls beat expectations with a sharp rise to 199,000 for November, while the US unemployment rate fell to 3.7% from 3.9% previously. Meanwhile, the German Harmonized Index of Consumer Prices (YoY) was steady at 2.3% in November, in line with expectations, with monthly figures reflecting a 0.7% decline as in October.

Market forecasts suggest that the European Central Bank (ECB) will keep the key refinancing operations rate at 4.5% in its upcoming monetary policy statement on Thursday. Furthermore, expectations point to the start of interest rate cuts by the ECB in March 2024.

On the other hand, there is speculation about the future course of US Federal Reserve (Fed) interest rates and the period for which the policy rate will be limited. However, the consensus expectation is that the Fed will keep interest rates at 5.5% at its upcoming monetary policy meeting on Wednesday.

The US Dollar Index (DXY) remains strong above 104.00, supported by positive US Treasury yields. Currently, the 2-year and 10-year US bond coupon yields stand at 4.24% and 4.73%, respectively.

Investors are expected to closely monitor US consumer price index (CPI) data on Tuesday for potential market implications. Additionally, ZEW Survey – Germany will release economic sentiment for December, adding to the market’s focus