-

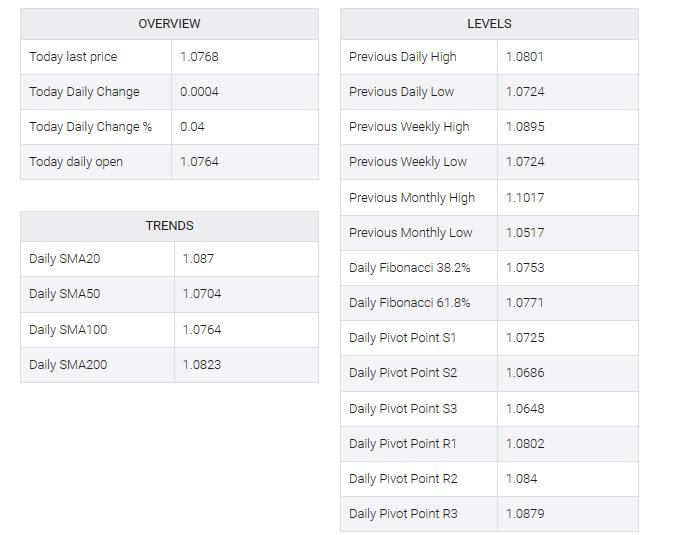

EUR/USD holds ground near 1.0770, up 0.06% on the day.

-

The US labour market may convince the Federal Reserve (Fed) to delay rate cuts in 2024.

-

The market expected the European Central Bank (ECB) to hold rates until the inflation will return to target in a timely manner.

-

Traders will monitor US inflation data ahead of the FOMC, ECB monetary policy meeting.

The EUR/USD pair started the new week on a positive note in the early Asian session on Monday. The pair’s rebound is supported by a consolidation in the US dollar (USD) following stronger-than-expected US employment data. At press time, the major pair was trading at 1.0770, up 0.06% on the day.

The US labor market improved in November with expected growth, lower unemployment and higher wages, according to the US Bureau of Labor Statistics (BLS) on Friday. Treasury bond yields immediately rose substantially as investors speculated that the report could persuade the Federal Reserve (Fed) to delay cutting rates until 2024.

US Nonfarm Payrolls (NFP) added 199K employees, above market expectations of 180K. Meanwhile, the unemployment rate fell to 3.7% from 3.9%, and average hourly earnings were unchanged at 4.0% YoY.

Across the pond, German inflation data, as measured by the Harmonized Index of Consumer Prices (HICP), came in at 2.3%, in line with market consensus. Markets expect the European Central Bank (ECB) to hold interest rates until inflation returns to a timely target and begin cutting interest rates in March 2024.

The Federal Open Market Committee (FOMC) and ECB monetary policy meetings will be in the spotlight this week. Ahead of the key event, market participants will take cues from the US Consumer Price Index (CPI) due on Tuesday. Annual inflation data for November is projected to ease from 3.2% to 3.1%, while core inflation is expected to remain unchanged at 4.0% YoY.