-

GBP/USD recovers some lost ground near 1.2550 on the consolidation of the US Dollar.

-

The US Nonfarm Payrolls beat the market expectations in November, adding 199K new jobs to the US economy.

-

The BoE is likely to keep borrowing costs at a 15-year high at its December meeting on Thursday.

-

Investors will focus on the UK employment data and US inflation data, due on Tuesday.

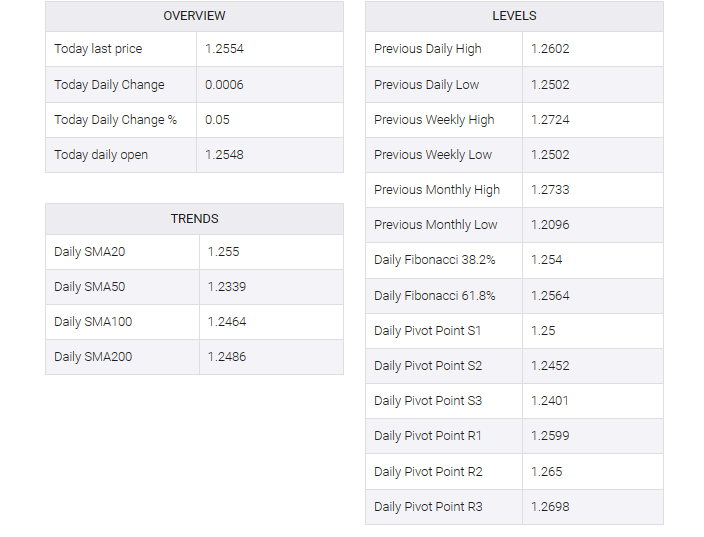

The GBP/USD pair maintained a positive base in the early Asian session on Monday. The pair recovered some lost ground from Friday’s low of 1.2500 and is currently trading near 1.2551, a gain of 0.03% on the day. US nonfarm payrolls came in better than market expectations Traders await key events from the FOMC and BoE meetings this week, and these events could cause market volatility.

Bank of England (BoE) Governor Andrew Bailey said last month it was too early to think about a rate cut and warned there was “no room for complacency” on inflation despite the consumer price index falling from 6.7% in September to 4.6% in October. The BoE may keep borrowing costs at a 15-year high at its December meeting on Thursday.

US nonfarm payrolls beat market expectations in November, adding 199K new jobs to the US economy from October’s print of 150K payroll additions. Furthermore, the unemployment rate fell to 3.7% from 3.9% while average hourly earnings remained unchanged at 4.0% YoY.

Last week, US Federal Reserve (Fed) Chair Jerome Powell said earlier this month that it would be premature to confidently conclude that the Fed has achieved a sufficiently restrictive stance to control inflation. Powell added that we are prepared to tighten the policy if it is appropriate to do so. Nevertheless, investors speculated that the upbeat US nonfarm payrolls (NFP) report could convince the Federal Reserve (Fed) to delay cutting rates in 2024.

Market players will keep an eye on the UK employment data, including Employment Change, Claimant Count Change, and ILO Unemployment Rate, due on Tuesday. Also, the US inflation data, as measured by the US Consumer Price Index (CPI) will be released later on Tuesday. The focus will shift to the US FOMC meeting on Wednesday and the BoE policy meeting on Thursday.