-

USD/CAD extends its losses for the third consecutive day as the US Dollar halts its gains.

-

WTI price hovers with a positive sentiment on resilience in the US economy.

-

FOMC embarks on its two-day policy meeting on Tuesday; US CPI for November will also be eyed.

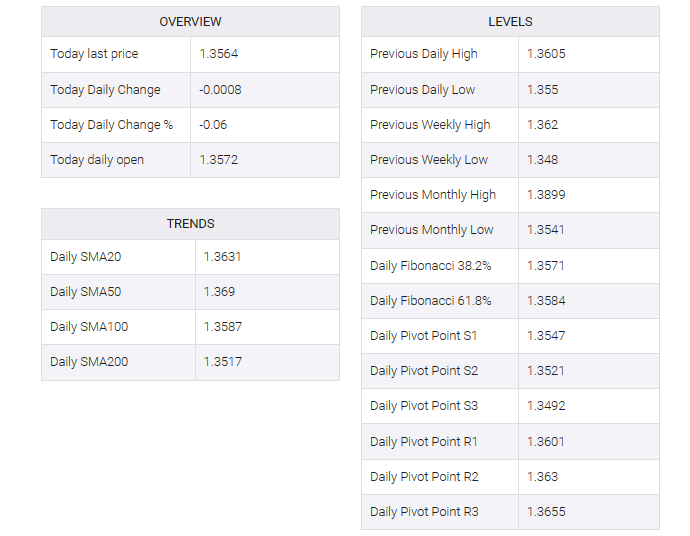

USD/CAD continued its third straight day of losses as the US Dollar Index (DXY) turned negative after two days of gains. The USD/CAD pair traded near 1.3560 during the Asian session on Tuesday. Furthermore, crude oil prices held steady after a three-day winning streak, potentially providing support for the Canadian dollar (CAD).

West Texas Intermediate (WTI) traded near $71.70 a barrel in the Asian session on Tuesday. Oil prices rose after the release of last week’s data, which indicated a level of resilience in the United States (US) economy.

However, crude oil prices may face challenges due to ongoing concerns about global demand, particularly weak economic data from the world’s largest oil importer, China, and other major economies. Additionally, concerns over oversupply persist despite production cuts imposed by OPEC+ members.

The US Dollar Index (DXY) lost ground amid steady US Treasury yields. DXY bids lower below 104.00 at the time of writing. The US dollar gained momentum from strong employment figures in the United States (US).

As the Federal Open Market Committee (FOMC) begins its two-day monetary policy meeting on Tuesday, consensus expectations are for interest rates to remain unchanged. Market participants will closely scrutinize the statement for any indication of possible rate adjustments in the coming year.

Additionally, Tuesday will be marked by the release of the US Consumer Price Index (CPI) report for November, which will provide insight into the likely path of monetary policy. In Canada, an appearance by Bank of Canada (BoC) Governor Tiff McCollum is scheduled for Friday. This event could be significant, and market participants will likely pay close attention to any insights or comments regarding the Canadian economic outlook and monetary policy.