-

AUD/USD holds positive ground near 0.6700, down 0.03% on the day.

-

The preliminary US S&P Composite PMI for December arrived at 51.0 vs. 50.7 prior, the fastest pace since July.

-

The Chinese economy showed indications of moderate growth in November, with factory output and retail sales growing.

-

Investors await the Reserve Bank of Australia (RBA) Meeting Minutes on Tuesday.

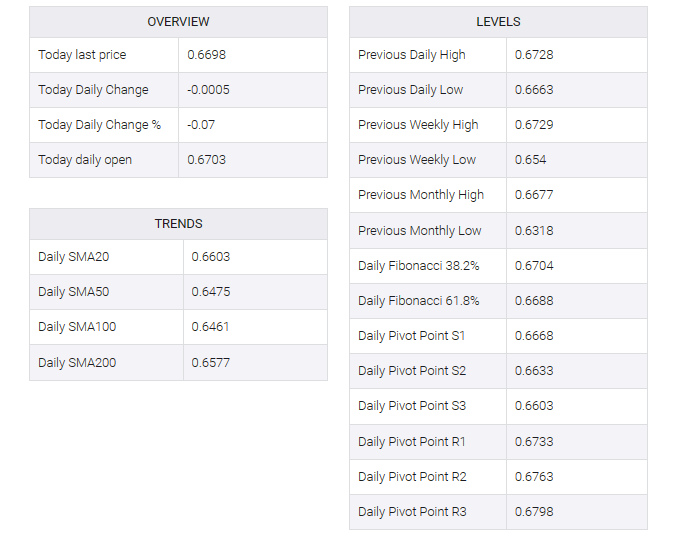

The AUD/USD pair hovers around the 0.6700 mark, its highest since July during the early Asian session on Monday. The anticipation of rate cuts by Federal Reserve (Fed) officials weighs on the US Dollar (USD) broadly and lends some support to the AUD/USD pair.

On Friday, Atlanta Fed President Raphael Bostick said the central bank could begin cutting interest rates in the third quarter of 2024 if inflation eases as expected. Additionally, Chicago Fed President Austin Goolsbee added that he did not rule out the possibility of a rate cut at the Fed’s next March meeting.

US business activity expanded at the fastest pace since July, according to US S&P Global Purchasing Managers’ Index (PMI) data on Friday. December’s preliminary composite PMI came in at 51.0 from 50.7 in November. Manufacturing PMI fell to 48.2 from 49.4, while Services PMI rose to 51.3 from 50.8.

The Chinese economy showed signs of moderate growth in November, with factory output and retail sales rising, according to China’s National Bureau of Statistics on Friday. But despite the government’s promise of policy support, the property market remained weak. The market expects additional stimulus measures in the first half of 2024 to boost demand in the property sector along with lower lending rates. Any positive developments around the Chinese economy could lift the China-proxy Australian Dollar (AUD). China is Australia’s largest trading partner.

Investors will focus on minutes from the Reserve Bank of Australia’s (RBA) latest meeting on Tuesday, as well as US housing data, including building permits and housing starts. This week’s highlight will be the Core Personal Consumption Expenditure Price Index (PCE) report on Friday.