-

USD/CAD snaps its losing streak as the US Dollar holds its position above 102.50.

-

BoC Governor Tiff Macklem’s hawkish comments might have supported the Canadian Dollar.

-

Traders await Canadian Core CPI data for fresh impetus in inflation conditions.

-

Fed members’ dovish remarks put pressure on the US Dollar.

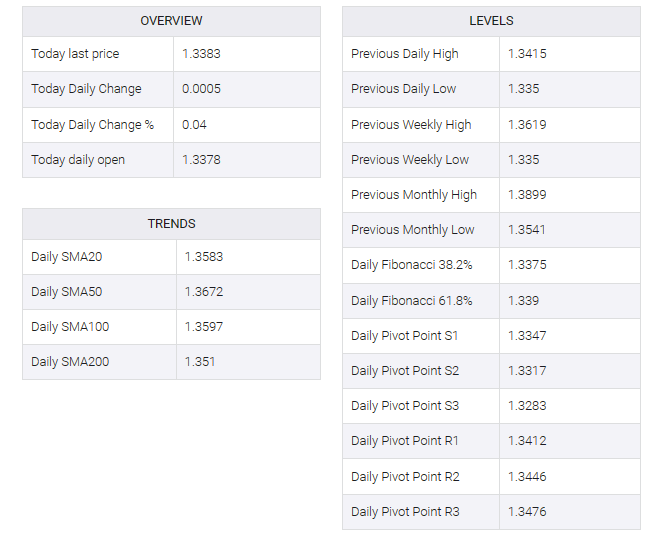

USD/CAD snapped its three-day losing streak, trading around 1.3380 during the Asian session on Monday. However, the Canadian dollar (CAD) rose against the US dollar (USD) on Friday after Bank of Canada (BOC) Governor Tiff McCullum’s taunts. Speaking at the Canadian Club in Toronto, he noted that once the BoC is confident that the economy is clearly back on the path to price stability, they will consider if and when to cut policy interest rates.

Governor Macklem made it clear that it was too early to think about cutting interest rates, stressing that they don’t have to wait until inflation returns to the 2% target to ease policy, but that it should clearly be headed in that direction. . BoC Consumer Price Index core data for November will be released on Tuesday, indicating changes in the prices of a specific basket of goods and services.

The US dollar index (DXY) is struggling to hold its ground after rebounding from a four-month low hit at 101.77 on Thursday. DXY moved above 102.50 as of press time. The greenback received support from higher short-term yields on US Treasury bonds. The 2-year US bond yield improved to 4.48% on Friday but was trading lower at 4.43% at the time of writing on Monday. While the 10-year US yield stands at 3.92%.

The USD received support from mixed preliminary Purchasing Managers’ Index (PMI) data for December. The S&P Global Services PMI rose to 51.3 from 50.8, indicating expansion, while the Manufacturing PMI fell from 49.4 to 48.2, suggesting contraction. Investors’ attention will now turn to changes in consumer confidence and existing home sales on Wednesday.

However, the greenback may face pressure due to dovish comments from various Fed officials. Atlanta Fed President Raphael Bostick on Friday hinted at a possible interest rate cut in the third quarter of 2024 if inflation follows the expected trajectory. Additionally, Chicago Fed President Austin Golsby did not rule out a rate cut at the Fed’s next March meeting.