-

GBP/USD holds positive ground around the mid-1.2600s amid the USD softness.

-

BoE’s Broadbent said the central bank needs to see signs of clearer decline in inflation before it can conclude a downward trend.

-

The markets anticipate potential rate cuts worth 75 basis points by the Fed in the second half of 2024.

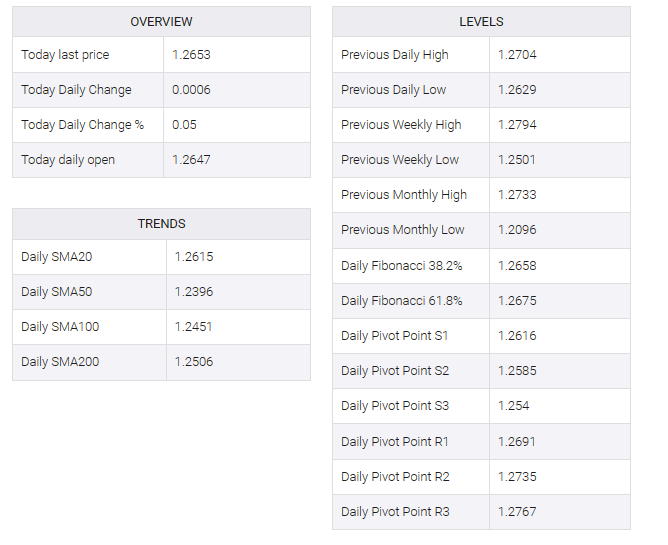

The GBP/USD pair snaps its two-day losing streak during the early Asian session on Tuesday. The rebound of the pair is bolstered by the weaker US Dollar (USD) and the lower US Treasury bond yields. Investors await the UK inflation data, due on Wednesday. The annual CPI and Core CPI figures are estimated to show an increase of 4.4% YoY and 5.5% YoY in November, respectively. The major pair currently trades near 1.2653, up 0.05% on the day.

The Bank of England (BoE) left interest rates unchanged at 5.25% for the third meeting in a row and maintained the view that borrowing costs need to be restrained for an extended period as inflation remains above its target rate. BoE Governor Andrew Bailey said it was premature to start speculating about cutting interest rates. He also said that further interest rate hikes have not been ruled out, but we are at the top of the cycle.

Still, BoE policymaker Ben Broadbent has argued that the Monetary Policy Committee needs to see signs of a longer and clearer decline in inflation before deciding that a downward trend is safely underway.

On the other hand, the Federal Reserve (Fed) provided a more equivocal stance with expectations of a possible rate cut of 75 basis points (bps) in the second half of 2024, while the BoE reiterated the tone that rates will remain high for longer, weighing on the US dollar (USD). And creates a tailwind for the GBP/USD pair.

US building permits and housing starts will be released on Tuesday. In the absence of economic data released from the UK docket on Tuesday, the GBP/USD pair remains at the mercy of the USD value. Market players will focus on November’s UK Consumer Price Index (CPI) and Producer Price Index (PPI) as well as US Consumer Confidence (December) and Existing Home Sales on Wednesday.