-

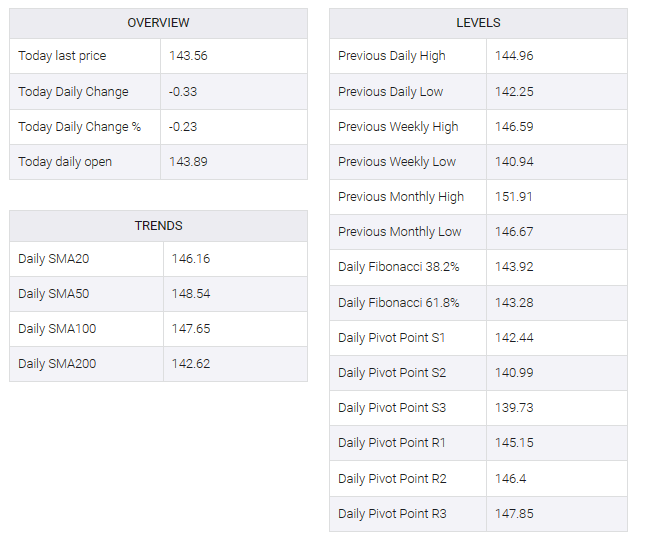

USD/JPY falls gradually to near 143.50 as rate cut expectations from the Fed deepen.

-

Fed policymakers fear that resilience in the US economy could make price pressures sticky.

-

The absence of dialogue on exiting ultra-loose policy by the BoJ forced investors to dump the Japanese Yen.

The USD/JPY pair corrected to near 143.50 amid expectations that the Federal Reserve (Fed) will start cutting borrowing rates ahead of policymakers’ expectations. Majors faced a sell-off as Fed policymakers failed to ease expectations of a rate cut despite warnings to prioritize achieving price stability.

S&P500 futures added some losses in the European session, portraying a risk-off mood while broader appeal remains bullish. The US Dollar Index (DXY) rebounded near 102.40 but the pullback move could be viewed by market participants as a selling opportunity.

The USD index is widely expected to be on the backfoot, even if the Fed does not declare an outright victory against inflation. Fears that resilience in the US economy could make price pressures sticky are forcing Fed policymakers to maintain a restrained stance on interest rates.

Going forward, investors will focus on the US core personal consumption expenditures price index (PCE) for November, which will be released on Friday. A further softening of the Fed’s preferred inflation tool is highly likely due to higher interest rates by the Fed.

Meanwhile, the Japanese yen is performing better against the US dollar despite unchanged interest rate policy by the Bank of Japan (BoJ). The BoJ left interest rates unchanged as expected but refrained from discussing an exit from ultra-loose policy.