-

EUR/GBP trades in positive territory for two straight days on Thursday.

-

The sharp fall in UK inflation data raises the odds that the Bank of England (BoE) will cut interest rates by May 2024.

-

Many ECB policymakers warned markets against betting on imminent rate cuts.

-

Investors will closely watch the UK’s GDP growth numbers for the third quarter (Q3), due on Friday.

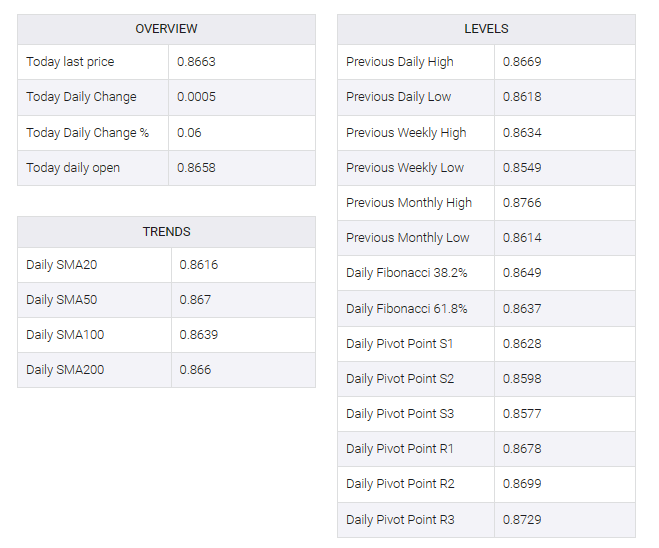

The EUR/GBP cross holds positive ground for the second consecutive day during the early European session on Thursday. The hawkish stance of the European Central Bank (ECB) lends some support to the cross. EUR/GBP currently trades near 0.8663, up 0.06% on the day.

Late on Wednesday, European Central Bank (ECB) Governing Council member Martins Kazaks said they would have to keep interest rates at current levels for some time, but the first rate cut could be in mid-2024.

Meanwhile, two ECB hawks warned markets against betting on an imminent rate cut. ECB policymaker Klaus Knott said uncertainty over the prospect of an economic recovery in the eurozone next year and the strength of wage growth meant there was no reason for the central bank to rush to cut rates. In addition, Joachim Nagel states that they must keep the current interest rate plateau in order to fully develop the inflation-solving effect of ad hoc monetary policy.

On the other hand, a sharp decline in UK inflation data prompted investors to raise their bets that the Bank of England (BoE) will cut interest rates in the first half of next year. November’s annual UK Consumer Price Index (CPI) rose 3.9% versus 4.6% previously, below market expectations of 4.4%, while core CPI fell to 5.1% in November from 5.7% in October, worse than expectations of 5.6%.

Markets are now fully pricing in a BoE rate cut by May 2024 and a cut of around 50% by March now. This, in turn, puts some selling pressure on the British Pound (GBP) and acts as a tailwind for the EUR/GBP cross.

Later on Thursday, UK public sector net borrowing and Italy’s producer price index (PPI) for November will be released. On Friday, UK Gross Domestic Product (GDP) for the third quarter (Q3) will be in the spotlight. Traders will take cues from the data and find trading opportunities around the EUR/GBP cross.