-

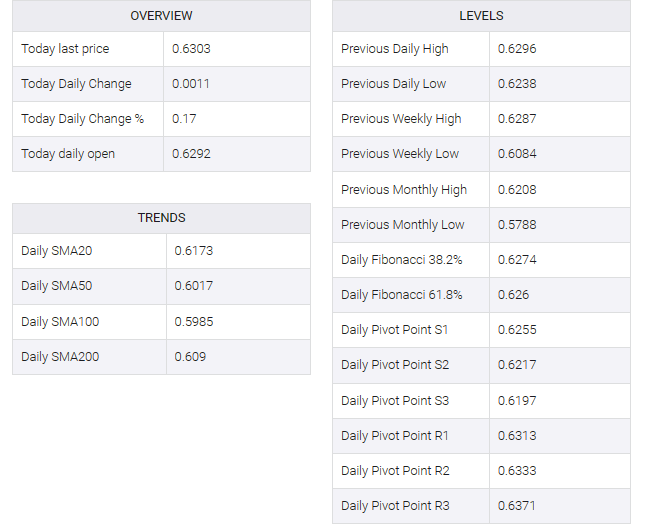

The New Zealand Dollar bounces up and heads to levels beyond 0.6300.

-

The US Dollar remains on the defensive following downbeat US GDP data on Thursday.

-

Investors await the release of the US PCE inflation to assess the timing of the Fed’s pivot.

The Kiwi resumed its uptrend in Friday’s European morning session, exploring levels above 0.6300. The US dollar is trading lower across the board ahead of the November PCE price index data release.

Data released Thursday showed the U.S. economy grew more slowly than previously thought in the third quarter. Q3 GDP was revised up to 4.9% annual growth from the previous estimate of 5.2%, with manufacturing and inflation data showing lower than expected readings.

These figures cemented investors’ view of an economic slowdown ahead and raised hopes for Fed tapering in 2024. In this scenario, the focus is on the release of the US PCE price index, the Fed’s favorite inflation reading, as the bank plans to ease for more information about the US central time.

PCE Inflation is expected to have remained flat in November, with the yearly rate declining below the 3% level for the first time in three years. The Core PCE, which strips out the impact of seasonal prices from food and energy is seen 0.2% up in the month and a decline, to 3.3% from 3.5% in October.