-

EUR/USD hits 18-week high on Friday.

-

Pre-holiday markets are producing some rough chop heading towards the Friday close.

-

Slowing US inflation is pushing down the Greenback as markets bet on rate cuts.

The EUR/USD climbed into an 18-week high at 1.1040 before slipping back towards 1.1000 as markets wind up operations before heading into the holiday break. US inflation missed the mark on Friday, printing below expectations and keeping investor expectations of Federal Reserve (Fed) rate cuts accelerating in 2024.

Read More: US PCE inflation softens to 2.6% from a year ago vs. 2.8% expected

The US Personal Consumption Expenditure (PCE) price index softened more than expected on Friday with the core annualized PCE price index coming in at 3.2% for the year from November printing, below forecasts of 3.3% and even slightly below 3.5% from October’s YoY print of 3.4% (revised). ).

Currency markets are raising expectations of a faster pace of rate cuts from the Federal Reserve (Fed) through 2024 on the back of inflation metrics that continue to decline faster than most models predict. Investor expectations are now well ahead of the Fed’s own rate expectations, with money markets pricing in a Fed rate cut above 160 basis points, with some betting the rate cut cycle will start as soon as next March, while the Fed’s dot plot interest rate expectations by the end of 2024 are only 75 Basis points decrease.

The market’s USD-short momentum was limited by a beat in USD Durable Goods Orders, which printed at 5.4% for November versus -5.1% for October (slightly revised from -5.4%), suggesting the US economy may still be strong enough that the Fed Rates may be cut less than many expect.

EUR/USD Technical Outlook

Despite the US Dollar’s moderate pullback late Friday, the Greenback remains firmly down on the week, in the red by nearly a third of a percent against the Euro from Monday’s opening bids.

The US Dollar is still up on the day against the Euro, and a green close here will see the EUR/USD close in the green for seven of the last nine straight trading week.

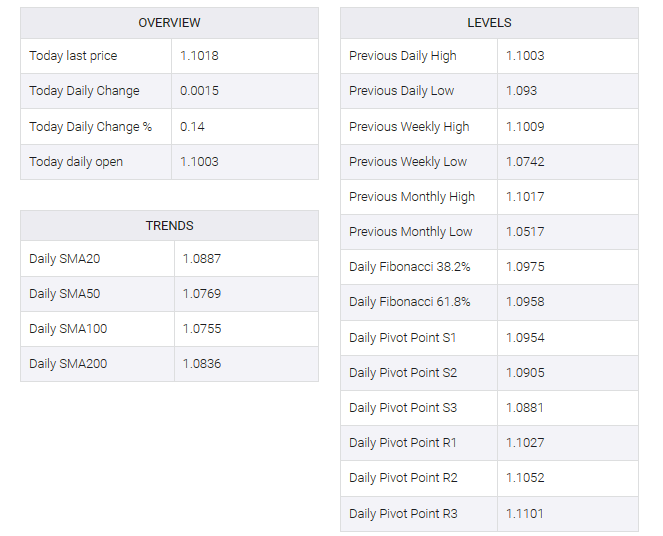

Technicals are leaning into the bullish side, leaving a wake of technical support flags in the pair’s wake on its rise from October’s early lows near 1.0450. The last meaningful swing low saw a turnaround point at 1.9793, and the 200-day Simple Moving Average (SMA) rising towards 1.0850.