-

USD/CAD extends its downside near the 1.3200 mark in a quiet session on Thursday.

-

US Richmond Fed Manufacturing Index fell to 11 in December versus -5 prior, weaker than expected.

-

The rebound in oil prices lends some support to the Loonie.

-

US Initial weekly Jobless Claims, Trade Balance for November, and Pending Home Sales will be released later on Thursday.

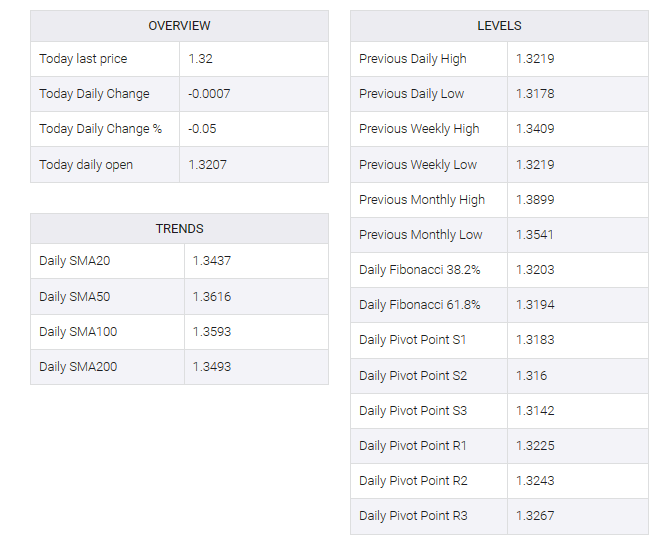

The USD/CAD pair trades in negative territory for the third consecutive week during the early European session on Thursday. The downward momentum of the pair is backed by the softer US Dollar (USD) and the lower US Treasury bond yields. The last week of 2023 is likely to be quiet as traders turn to holiday mode. At press time, USD/CAD is trading at 1.3204, losing 0.02% on the day.

On Wednesday, the US Richmond Fed manufacturing index fell to 11 in December versus -5 in November, a weaker than expected 7 drop. Meanwhile, the USD edge fell to its lowest level since July near 100.80. That being said, November’s US Core Personal Consumption Expenditure Price Index (Core PCE) bet on the Federal Reserve’s (Fed) initial rate cut in 2024. According to the CME FedWatch tool, the market is now pricing in more than 88% of rates starting in March 2024, with a 150 basis point (bps) cut in prices for next year.

On the Loonie front, the rebound in oil prices lifted the Canadian dollar (CAD) and acted as a headwind for the USD/CAD pair. Beyond that, the Bank of Canada (BOC) said in a recent meeting that an additional rate hike cannot be ruled out. However, markets speculate that the likelihood of another rate hike has receded and investors widely expect the next move to be an interest rate cut sometime next year.

Moving on, market players will monitor the US Initial weekly Jobless Claims, Trade Balance for November, and Pending Home Sales on Thursday. These figures might not have a significant impact on the market amid the light trading volume.