-

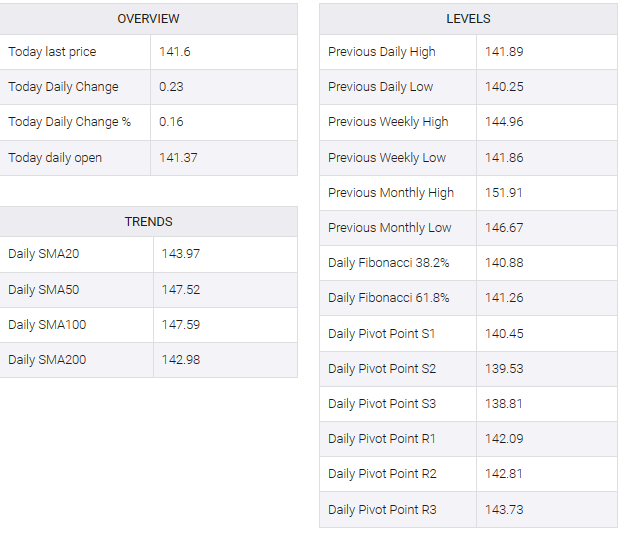

USD/JPY recovers to 141.65, adding 0.15% on the day.

-

US Initial Jobless Claims came in at 218K vs. the 210K expected in the third week of December.

-

BoJ’s Ueda stated the chance of moving short-term interest rates out of negative territory next year was not zero.

-

December’s US Chicago Purchasing Managers’ Index (PMI) is due on Friday.

The USD/JPY pair bounces off its lowest level since July of 140.23 and then rebounds to 141.65 during the early Asian session on Friday. The recovery of the US Dollar (USD) and higher US Treasury yields lift the USD/JPY pair. The economic calendar is light amid the thin trading volume on the last trading day of 2023.

Investors raised bets on interest rate cuts from the Federal Reserve (Fed) due to the signal of cooling inflation. This, in turn, exerted some selling pressure on the USD in the last few sessions. The US central bank confirmed that there won’t be rate hikes in 2024 while hinting at 75 basis points (bps) of easing. About the data, the US Initial Jobless Claims report from the US Department of Labor came in at 218K versus the 210K expected.

On the Japanese yen front, Bank of Japan (BoJ) Governor Kazuo Ueda said on Wednesday he was in no rush to unwind ultra-loose monetary policy as inflation remained well above 2% and risks of further increases were minimal. Ueda added that the key factor in the annual spring wage talks in 2024 is whether wage increases will be extended to small enterprises, although the BOJ may decide before the conclusion of small firms’ wage talks if their profits are good enough.

Looking ahead, market players will keep an eye on the US Chicago Purchasing Managers’ Index (PMI) for December, which is expected to decline from 55.8 to 51.0. Amidst the holiday season’s thin trading, the risk sentiment and the ongoing adjustments in central bank policies are expected to continue influencing the USD/JPY pair’s movements.